“Live well below your means. Try hard not to spend your raises.” Advice from a 43 year old with a $2.2 million net worth.

30 net worth updates from ordinary people trying to build wealth.

Weekly Summary - Net Worth Updates:

Each week, TenWilsons will publish two articles. First, on Wednesday, is one long-form detailed ‘net worth’ story. Second, on Saturday, is a weekly summary that is curated from reviewing hundreds of articles, personal finance blogs, and social network updates to find net worth updates posted in the last week.

This week we have 30 new net worth updates / stories. These are net worth updates from ordinary people in various professions and at different stages of building wealth. The one thing in common is that most started from $0 net worth or a negative net worth due to student loans.

Specifically this week, we have 5 updates from those reaching their first $100K net worth. We also have 3 updates from those reaching their first million net worth. We also have several updates from those retiring early or planning to retire early in their 40s/50s. Lots of great advice in all of these real net worth stories.

The goal of TenWilsons and NetworthShare collectively is to provide the tools and community to educate and motivate others to make more "informed" or "intentional" financial decisions and minimize the use of consumer debt

Sometimes the best opportunity for individual growth is by finding, watching, and learning from those that are just ahead of you. We hope you use these stories to make more informed financial decisions and create the life you want. Maybe you have been tracking your net worth for years or maybe you just found this site and are calculating your net worth for the first time. Either way, talking about finances with others is not easy, in fact, it is often considered taboo in our society. Therefore, this is a community where anonymously you can share and celebrate your financial milestones! So much of our society is focused on visible wealth (homes, cars, vacations, etc.) but as you will see for those that are trying to build wealth, most of it is not visible (it’s in a 401(k), brokerage, or bank account).

Each of these short net worth updates are teasers of their net worth stories. We try to highlight 1 or 2 takeaways, anecdotes or ideas that will hopefully inspire you (to conquer debt, save for retirement, etc.). Click on any of the net worth numbers below for a link to the source of the information. See you next week!

20s:

$47,000 - age 28 - He went back to school and graduated in 2023 - earning $78k as entry level data science role. He might seem behind others at age 28, but with no debt, he is in a great position and earnings will only increase - how he decides to spend or save/invest will determine his net worth in 10-20 years - “Since then I am out of debt, maxed out my Roth IRA for 2023 and 2024 while also saving some money each paycheck to fully fund 2025. I fully funded my 2023 HSA and on track to fully fund my 2024 HSA. For my 401k, I contribute 6% to a Roth 401k, my employer matches 50% on up to 6%, and they also give a 3% non-elective contribution.”

$100,000 - age 23 - married with 1 child (1 year old) - paid his own way through college - “I graduated summer of 2022 (first in my family to go to college) with no debt and a few thousand dollars saved” - software engineer (SF) - earning $120K salary + $55K in RSUs.

$100,000 - age 26 - single - US citizen living in Amsterdam, Netherlands - considering buying a home - As inspiration that you can choose different financial habits than your parents - “Growing up, my parents had a ton of debt and made all kinds of dumb consumer purchases like expensive trucks while we were losing our house. I say all this because I'm super proud that I've taught myself how to handle personal finances and invest”.

$100,000 - age 28 - single - As inspiration that even making bad decisions in college and graduating with $85K in student loans doesn’t have to be an anchor forever. However, you should take care of it before starting to spend on luxuries after graduation (see chart below) - “I graduated from a public university shortly after turning 21 with $85,000 in debt, and began my first job about a month or so after that. I was financially irresponsible. I lost my tuition scholarship after getting on academic probation with a 1.62 GPA my freshman fall semester. I used my student loans to help pay rent in apartments I couldn’t afford, as well as bar tabs and club dues like a dumb college kid. Hence $85k for my time at a public in-state university.”.

€111,000 - age 30 - Another inspirational story of starting with 160 Euros and by saving 80% of their salary they reached their first €100,000. “I am very excited to reach that milestone as I arrived in France with only 160€ for my master Degree & came from one of the poorest countries in the world. I had set clear goals across 2023 and the output is great. I started working end of 2019”.

$119,000 - age 27 - single - The reality is living at home is not what you want after graduation but it can have a big impact on your ability to save your first $100,000 - “I was working out of town for some years but I’m currently back home and living with parents at the moment. I plan on purchasing a home soon but no real rush”. Net worth composition: $66K in a HYSA (saving for home down payment), $6K in Roth IRA, $40K in 401(k), and $7K in a pension plan.

$145,729 - age 31 - single - paralegal - beginning salary was $43K but has worked hard to increase their skills as well as their earnings - now on a great path to wealth building - “I grew up in a single parent immigrant household. We lived in a low income city and were eligible for reduced lunch. My sister and I both went to college on (almost) full ride scholarships and graduated. I do not receive any financial support from my parents.”

$150,000 - age 24 - This is a great example of minimizing lifestyle upgrades as your income increases. Use the opportunity to save and invest the difference. “I started a new job half a year ago that bumped my income from 40k to 90k so we expect our NW growth to increase much faster in the coming years. We are both currently maxing out 401k’s and Roth IRA’s, while contributing leftover money (post expenses) to brokerages/HYSA’s”.

$477,000 - age 29 - Like many of our other examples - they didn’t start with a silver spoon - they have saved an amazing amount considering their salary level and age - they use their own unique strategy to trick themselves into saving for the future - “barely pushing $100K salary. No debt, No hand outs, no trust fund. Just hustling. Max everything out HSA, 401k, IRA. Live very frugal. I'll do stupid stuff like - I want a new car! Make a down payment to my brokerage account, and make $800 payments to the account... while not actually getting the car.”

$500,000 - age 28 - married - Too many times, people focus on trying to pick the right investments or time the market - This couple chooses to keep it simple with a high savings rate and low cost index funds - “We abide by the vast majority of boglehead rules- max out 401K / IRAs, invest in low cost index funds (~100% stocks), high savings rate of 50%.”

30s:

$880,000 - age 38 - widowed with 1 child - currently earning $185K and saving $100K/year (maxing out 401(k), Roth IRA, and taxable account savings) - takeaway here is the importance of having a financial plan. “I figure with saving $100K/year, in 8 years I will have $1.5M, plus approximately a doubling of the $700K I have already (rule of 72), for $2.2M. That puts me at a 3.6% WR to make my $80K. I am aiming to retire in 8 years (age 46). In 8 years my child will be mid-way through freshman year at college.”

£990,900 - age 33 - married with 2 children under 5. Lives in Wakefield, Yorkshire UK and works in Cyber Security. On the verge of first million in net worth - “I've always been obsessed with frugality, getting the most from my money and have recently discovered the FIRE movement (Financial Independence Retire Early)”

$1,000,000 - age 38 - married in 2022 - $1M at 38 is impressive but here is what he shared about getting to the first $100K which made the $1M before 40 even possible - it includes frugality, house-hacking (roommates), and driving a used car but he did prioritize spend on travel/experiences - “The first $100k took about 3.5 years. I graduated college with about 10k in loans. I earned a salary of about 50k for those years - so 175k total, give or take. I continued to live the broke college life. I got a $550/month apartment, drove the car I had since I was 16, packed lunch for work. I did however indulge in a yearly international vacation.”

$1,000,000 - age 38 - like many she started with $0 and invested in an education to increase her earning potential. Takeaway here is it takes intentionality about what you spend on vs not spend on based upon your own values and goals. It takes some sacrifice at the beginning to get the compound machine going - “I was eating homemade bagel sandwiches everyday and living in shitty apartments. I didn’t deny myself some luxuries once in a while like traveling, but I definitely was more responsible than a lot of my peers… I lived in apartments that weren’t great and/or with roommates and further away so my commute was longer and not eating lunch out everyday but it pays off in the end”

$1,373,000 - age 37 - single and no kids - $450K in home equity and $923K in retirement and brokerage accounts - An example of don’t be afraid to live a life that’s what you want and not just doing what everyone else is doing - she has a plan to be financially independent in the next 5 years - “Ideally, I want to have the luxury of not having to work before I turn 42. I have no children and don’t plan to have children. I just plan to be by myself so no one else to worry about. Drama free life is what I seek.”

$1,930,000 - age 38 - married with 2 kids - some people are over the top in their planning which can provide consistency and results - he has done a detailed written story for each of the last 9 years starting when he was 29 years old - 2015, 2016, 2017, 2018, 2019, 2020, 2021, 2022, and 2023 updates -

First update in March 2015 with $434K net worth - “Also, I generally like my career, so I don't mind too much if I end up working for money until about age 50 (after that, all bets are off).”

Recent Update from 3/1/24: “I find sharing my plans and progress to be helpful for giving myself a heading check, and hope this community finds my inputs to be helpful. If you start digging back into those older posts, you'll notice a running theme - boring consistency and gradual improvement. No dramatic changes, no crypto or gimmicks. These posts themselves are probably getting a little repetitive - but I think the results over the long term speak for themselves.”

40s:

$615,000 - age 43 - married with 1 toddler - dual income - “Been in the country (USA) for about a decade - Arrived from a poor LATAM country with debts to pay back home.” Like many others, their future plans include working to obtain financial independence and creating optionality for later in life - “I plan on working till my 59-60 birthday - highly unsure what the world would look like by then, so keeping my options open. We both have a European passport also (besides the American), and have spent some time there. We are currently entertaining the idea of retiring somewhere in south Europe, but again, leaving my options open.”

$760,000 - age 40 - married with 1 child - currently earning $110K at sales job and has additional income of $40k annually from a side business. $600K house with $175K mortgage balance remaining - currently has $780/ month car payments ($30K loan balance) and $1,600/month mortgage - plan is to paydown debt and save more for retirement - currently contributing 15% to 401(k) - “I just set the contribution rate at 16%. Once I pay off one auto next year I should be able to go up to 20%

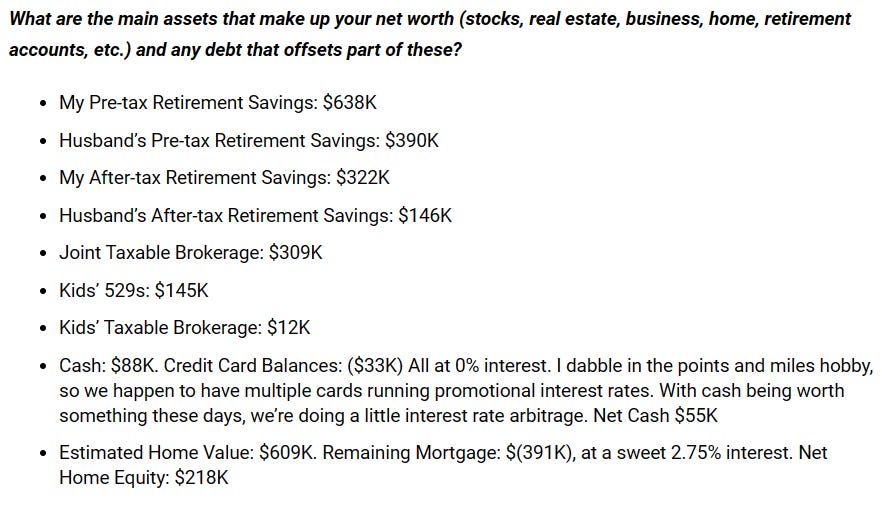

$2,230,000 - age 43 - married with 2 daughters - she is a finance manager for a global non-profit and he is a Research Assistant at local university - combined income $190K - live in a suburb of Philadelphia - Best tip for saving (accumulating money)? “Live well below your means. Try hard not to spend your raises.” - That’s exactly what they have done - over $1M in retirement savings (see below net worth composition)

$6,800,000 - age 47 - married with 2 kids in college - dual income - They soon will be going to a $15M net worth after company acquisition - they are trying to decide if that is “enough” - takeaway here is that everyone needs to figure out their personal target number of what they are saving for and it depends on required lifestyle and annual spending (typically liquid investments x 4% provides a a safe withdrawal rate (SWR) from a portfolio) - “I’m about to get a high 7-figure payout (net) from a company acquisition and am trying to decide if we are ready to officially hang it up and RE”

50s:

$900,000 - age 50 - married - multiple kids - what is very common for those in late 40s and 50s, is that they have a plan for their savings - whether they are paying for their kids college or planning an early retirement - “Our plan for years has been to retire as soon as our youngest goes to college, so exactly 5 years. This would put us in mid-50s. We recognize we're maybe on the low side for a US retirement that early and don't particularly want to stay here anyway. So, our plan is a LCOL international destination -- likely LatAm but still taking research trips to narrow it down.”

$1,439,138 - age 51 - married with no kids - this is a long-form interview - some of the best financial takeaways - funding an emergency fund of $100K, maxing retirement savings early, catch-up contributions after age 50 and increasing saving rate as income increases - “Last year we saved about 60% of our gross income, and about 65% the year before that. Several years ago, we started maxing out our 401Ks and our individual Roth IRAs. After turning 50 last year, I started taking advantage of the catch-up contribution limits. Before maxing out our retirement accounts, we were saving about 40-45% of our income. I do not remember what percentage of my income I was saving when I first started my career in my mid-20s, but I know it was at least enough to get the employer match.”

$2,000,000 - age 50 - married - earnings $80K and annual spending is $52K - 401(k) savings $935K (~50% of net worth); T-bills 530K (~25% of net worth)

$2,900,000 - age 54 - single (divorced) with 1 kid - this is a good example of some considerations for early retirement - savings in a taxable brokerage account (as the bridge to age 59.5) - health insurance considerations - transfer 401(k) to Trad IRA and then eventually to Roth IRA - “Officially retire Spring, 2025 (I’ll be 55). Use money in brokerage account to bridge to 59.5/60 - Probably COBRA initially, then ACA (need to do more research on this) - Roth ladder $25k-$30k/yr from Trad IRA to Roth IRA from 55-60.

$3,150,000 - age 53 - married with 1 kid - unlike most net worth compositions, the majority of their net worth is in real estate $950K home and $2.1M in investment property (97% in real estate) - example of being cash poor but equity rich.

$3,800,000 - age 53 - dual US/European citizenship - similar to previous, also has significant percentage (71%) of net worth in real estate with no debt or mortgages - $1.1M in 401(k), $700K house, $300K commercial land, $1.7M house in Europe

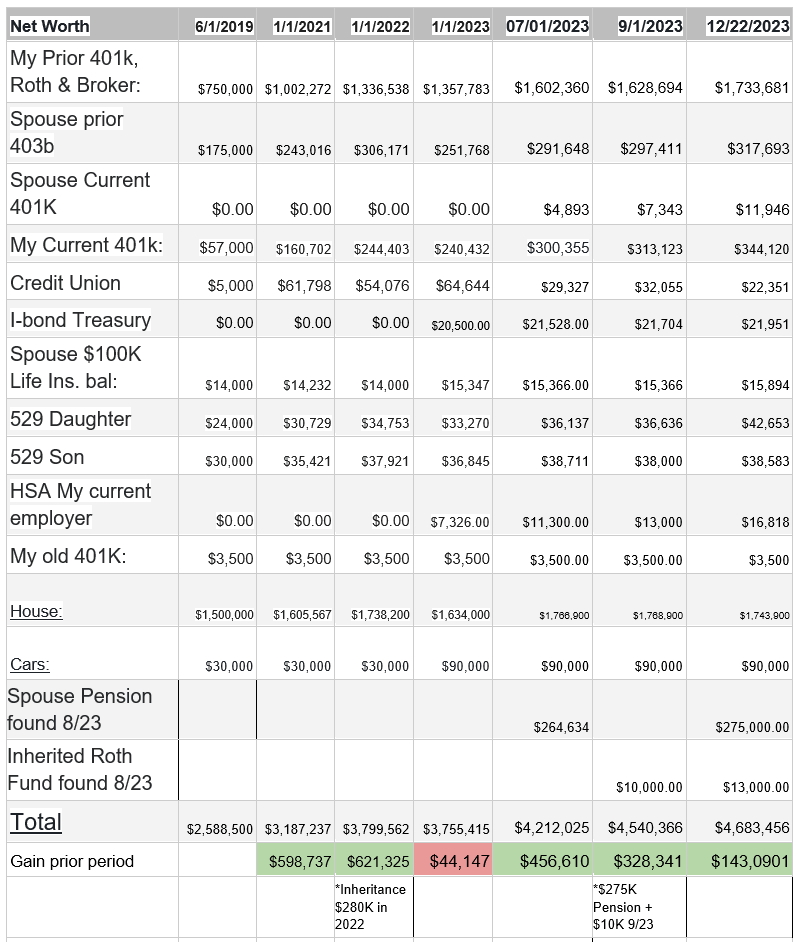

$4,683,456 - age 58 - married with 2 kids - long term 2 part interview (part 1/part 2) This is great example of living in the same house for 26 years (high friction costs when moving to upgrade) - did another interview in 2019 when net worth was only $2.5 million - planning to retire in January 2026 before turning 60 but after turning 59.5

$6,322,480 - age 50 - 2 lawyer couple living in a coastal city - detailed net worth entries going back to negative net worth in 2003 - $2.5M primary home and $1.6M beach home - high income couple

$7,300,000 - age 51 - married - he retired in early 2022 (2 year anniversary) - she plans to retire at 55 - $6.3M in investments/ $1M in real estate/ no debt - average annual spend is $90K/year - Takeaway here is an example of someone who is using a financial advisor and the reason why - “Investments are 'professionally managed' because I screwed up early on and never really trusted myself to do it correctly after that. I'm OK paying his fees, not cheaper than therapy but still gives me peace of mind.”

$9,200,000 - age 52 - married - 1 child in 7th grade - Large gap between earnings ($600K) and annual spending ($120K-140K) - comments on spending “Main expense is child in private school and paying off the mortgage. Our lifestyle is modest for our income - and our spending is informed more by our satisfaction and comfort rather than bling or keeping-up-with-the-Jones.”

What is the meaning behind Ten Wilsons?

The $100,000 bill is the highest denomination ever issued by the U.S. Federal Government. Woodrow Wilson is the president on the $100,000 bill.

In theory, if you had 1 of these $100,000 ‘Wilson’ bills you would have $100,000 net worth. If you had 2 Wilsons you would have a $200,000 net worth. Therefore, if you had 10 Wilsons you would have a $1 million net worth. Therefore TenWilsons = Millionaire

Looking for more TenWilsons content?

We will also be providing new personal financial metrics that you won’t see elsewhere (example: net worth composition analysis: % of net worth in home equity vs retirement accounts at various ages; the 8 levels of financial independence; data of visible vs non-visible wealth). We also recently started doing data visualizations to help turn data into interesting charts and interactive stories. Follow TenWilsons on twitter where you can get daily content and other helpful financial tips.

Please share with others!

There are 1000s of financial influencers on social media that don’t have experience in building wealth and just offer mediocre investing advice. We are trying to build something that offers more real value to the readers. If you are finding this newsletter interesting or helpful, please it share with others so we can gain more followers!

Our weekly net worth story in case you missed it!

He followed these 4 steps (in his 20s, 30s, and 40s), became a multi-millionaire, and retired at age 51.

Net Worth Stories: Every Wednesday, we focus on a net worth “story” to help you peek inside someone’s personal finances and get the inside view that nobody usually talks about. This week we have a 54 year old. He is married and retired at 51 when his net worth reached $3 million. We share the 4 steps he followed to become a multi-millionaire. He also…