Net worth defined

Net worth is assets minus liabilities. Or, you can think of net worth as everything you own less all that you owe. Below, we walk you through the steps to determine your net worth.

What is my net worth?

To calculate your net worth, take inventory of what you own, as well as your outstanding debt. And when we say own, we include assets that you may still be paying for, such as a car or a house.

For example, if you have a mortgage on a house with a market value of $300,000 and the balance on your loan is $250,000, you can add $50,000 to your net worth.

Basically, the formula is:

ASSETS minus LIABILITIES equals NET WORTH

Do I include my income in Net Worth?

No, your income is not included in a net worth calculation. If your income just goes to paying expenses it does not add to your net worth. Example, you can be a high income earner but still have a low net worth if you spend all of your money. Alternatively, even people with modest incomes can accumulate significant wealth and achieve a high net worth over time if they save a portion of their income every pay period and buy assets that appreciate over time (i.e. stocks and real estate).

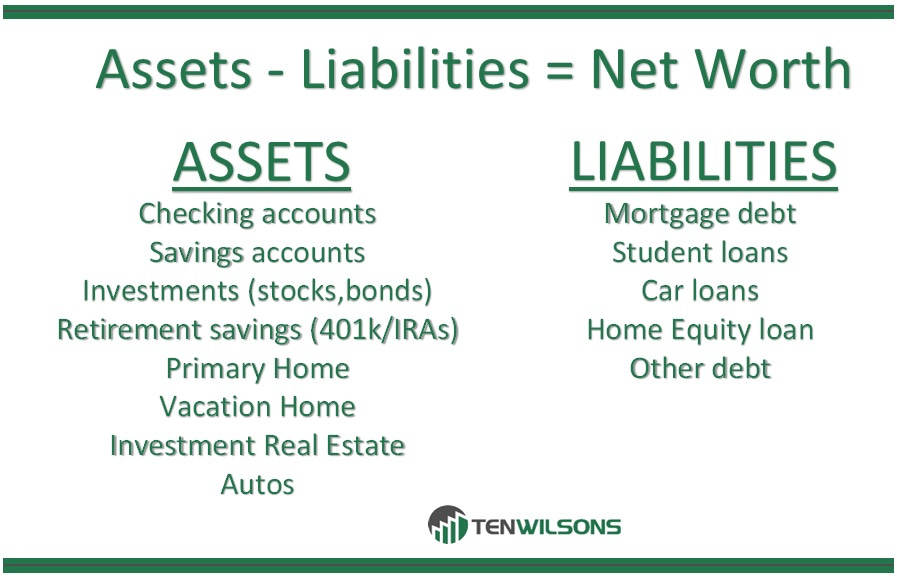

Calculating net worth: What are assets and liabilities?

If you’re not sure what assets and liabilities are, here are some guidelines:

Assets: Assets include cash — such as in your checking, savings and retirement accounts — and items such as cars, property and investments that you could sell for cash. These are often referred to as liquid assets. Not all of your assets are considered liquid (ability to sell) like your home but they should still be included in your net worth as you could downsize or rent as an alternative.

Liabilities: Any money you owe to another person or entity falls under this category. That includes your mortgage debt, student loans, auto loans and any other personal loans or credit card balances.

Get our FREE net worth tracker for subscribing to Ten Wilsons!