“I always knew I didn’t want to live on debt” -traveling nurse pays off $50K in student loans. 15 net worth updates from ordinary people (in their 20s/30s) working for others and building wealth.

PLUS: 5 wealth building tips for anyone in their 20s and 30s

Weekly Summary - Net Worth Updates:

Each week, TenWilsons will publish two articles. First, on Wednesday, will be a detailed ‘net worth’ story chosen from thousands of net worth progressions on NetworthShare.com. Second, on Saturday, will be a weekly summary that is curated from reviewing hundreds of articles, personal finance blogs, and social network updates to find net worth updates posted in the last week.

This week we have 15 new net worth updates / stories. These are net worth updates from ordinary people (in their 20s/30s) in various professions and at different stages of building wealth. The first update is from a man enlisted in the military reaching $100K net worth at age 22, a 26 year traveling nurse with $153K net worth, and a 27 year old with a goal to retire at 45 years old.

We also have six different $1 million+ net worth updates from individuals and couples in their 30s. Three of the six started with $50K-85K in student loans in their 20s. This means they started with a negative net worth and still achieved their first million in net worth in their 30s! There are likely 1 or 2 takeaways from their actions that might help inspire you to paydown debt, save, and invest.

The goal of TenWilsons and NetworthShare collectively is to provide the tools and community to educate and motivate others to make more "informed" or "intentional" financial decisions and minimize the use of consumer debt

We hope you find these stories inspirational. They say the best opportunity for individual growth is by finding, watching, and learning from those that are just ahead of you. We hope you use these stories to make more informed financial decisions and create the life you want. Maybe you have been tracking your net worth for years or maybe you just found this site and are calculating your net worth for the first time. Either way, talking about finances with others is not easy, in fact, it is often considered taboo in our society. Therefore, this is a community where anonymously you can share and celebrate your financial milestones! So much of our society is focused on visible wealth (homes, cars, vacations, etc.) but as you will see for those that are trying to build wealth, most of it is not visible (it’s in a 401(k), brokerage, or bank account).

Each of these short net worth updates are teasers of their net worth stories. These stories have anecdotes and ideas that will hopefully inspire you (conquering debt, saving for retirement, etc.). Click on any of the net worth numbers below for a link to the source of the information. See you next week!

20s:

$100,000 - age 22 - dropped out of college in 2021, enlisted in the military and increased financial literacy - 50% savings rate - current plan is to be financially independent by 35

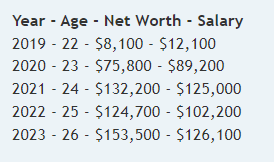

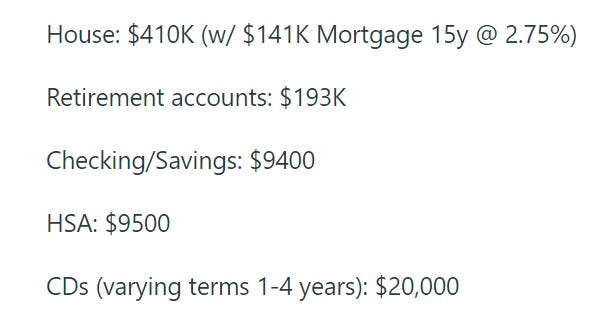

$153,500 - age 26 - traveling nurse living in southern California earning over $100K salary - “Relatively uneventful year. Same staff job and became eligible for 401a and 403b in May; no major expenses but lots of travel for weddings, holidays, and skiing.”

$154,000 - age 27 - earning $120K - $42K in 401(k) - $20K in Roth IRA - cash in HYSA - three financial goals listed below:

$1,007,547 - age 29 - married no kids - graduated with math degree and then pursued a masters in computer science - started first job in 2019 earning $105K annually - currently has 2 remote software jobs plus married in 2020 and wife is now working too - just crushing the savings to reach $1 million net worth before 30

30s:

$83,000 - age 38 - showing its never too late - recently eliminated credit card debt and stopped chasing meme stocks. Focused now on increasing contributions to retirement and taxable brokerage accounts using a three fund diversified approach

$500,900 - age 34 - married with 2 kids - dual incomes - wife works in HR ($80K) and husband works in insurance underwriting ($75K).

$690,008 - age 38 - “my best financial decision was maxing out 403(b) and Roth IRA” - passionate about personal finance - $416,983 in retirement accounts (60% of net worth). Note - 403(b) is a retirement account similar to a 401(k), but for public school, church and other not-for-profit organizations.

$812,000 - age 37 - married with 2 kids - four investment properties - tweets about the ups and downs of real estate investing under the title The Frugal Mogul

$836,000 - age 32 - In 2018, he was a 1st year resident physician with $210K in student loans earning only $56K/year - Now he is married earning $400K/year + wife that is earning $225K working in tech industry.

$1,010,000 - age 33 - single - started off working 10 years ago as a technician earning $45K/ year - currently, engineer making $140K/year - Maxing out 401(k), 15% into ESPP and additional $1K/month into vanguard ETFs.

$1,250,000 - age 35 - Sophia is a traveling nurse practitioner - lives in Miami FL - 4 year BSN - volunteered in Haiti - went to graduate school and accumulated $50K of student loans - created a debt payoff plan and paid off student loans in 3 years - “I always knew I didn’t want to live on debt” - also as a contract traveling nurse she gets free housing most of the year

$1,420,000 - age 36 - single - net worth started at negative ($85K) in 2016 with student loans - reached first $100K in net worth at age 30 and $1M net worth at age 34 - earnings started at $150K and have grown to $450K+ - spending started at $50-75K and has only increased to $90-95K range despite 3X increase in earnings

$1,500,000 - age 36 - single - VHCOL - purchased home in 2022 - $490K in 401(k) - net worth started at negative ($80K) in 2016 due to student loans - wrote a long post in March 2022 when she first crossed $1M net worth

$2,000,000 - age 38 - married with 2 kids - “Took over 13 years after graduating and first job to hit $1M (joint with wife) and then only 3.5 years after that to hit $2M. I haven't done anything crazy. Index fund investing, maximize retirement accounts, continue to increase salary (but no stock options or sales of business or anything like that), live below means, kids now finally out of daycare/private school.”

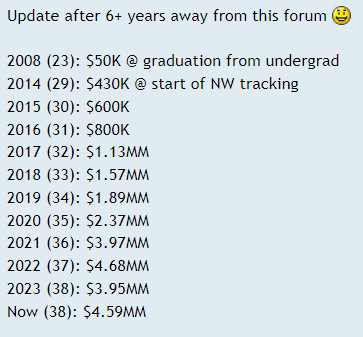

$4,590,000 - age 38 - married with 2 kids - first $1M net worth was in 2016 (age 32) (while living inexpensively in Shanghai for 4 years) - didn’t own a car for over 8 years - “Slightly odd progression from 2020 onwards due to highly speculative cannabis investing which went up like a rocket ship and then abruptly crashed back to earth. Sadly, most of the positions are/were illiquid, and I couldn't cash them out at the peak. Plus, my annual spend has jumped dramatically due to having 3 kids 5 and under and moving back to the US to a VHCOL area.”

5 things you should be doing in your 20s/30s to start building wealth

#1) Focus on EARNINGS!

Your greatest asset is the present value of your future earnings! A high income does not guarantee that you will build wealth. But building wealth without a high income is extremely difficult. Invest time and effort in building skills, continuously learning new things, and increasing your value / contribution to your employer. The more value you help create - the higher compensation you can demand!

#2) Start and increase SAVINGS

Savings creates future optionality in life! Earning more doesn't guarantee wealth generation. Wealth (net worth) only increases from earnings not spent. Increase your savings % as your income grows.

The single way most multi-millionaires achieved wealth was by spending less than they earned. If you notice net worth updates from those in their 40s/50s, the majority of their wealth is non-visible (it’s in a 401(k), a Roth IRA, a brokerage account or investment real estate).

What should you do with your savings? Don’t just leave it in your checking account. I recommend keeping your cash savings (money you might need in the next 1-3 years for home down payment, vacations or emergency fund) in a high-yield savings account (HYSA). I recommend American Express Savings Bank (4.35%) or Apple Savings (4.50%) via Goldman Sachs Bank which is right in your iPhone wallet. You can probably get slightly higher rates elsewhere but these have ease of use and ability to transfer money back to your checking account typically same day or next day. Don’t keep your money in a traditional bank savings or checking account (which probably only pay 0.00%-0.25% interest).

#3) Don’t just save - INVEST! Don’t wait until you’re older to start investing for retirement - It’s all about the doubles!

In the thousands of net worth profiles reviewed, nearly all of them begin by contributing money to their workplace 401(k) account. If you can’t afford to contribute the maximum amount, at least make sure you’re contributing enough to receive your employer’s full match (instant 100% return!). As your earnings increase, increase your savings rate (%).

Once your 401(k) is fully funded, it’s a good idea to shift your focus over to IRA accounts. With a Roth IRA, you will invest post-tax money into the account. Your investments will grow over time and you won’t be required to pay taxes on withdrawals in retirement.

The longer your money has to work, the more it will grow. This is due to compounding. Time is the best way to maximize your investment growth. When you start investing money at a younger age, your balance has a longer time horizon to compound (think of it as how many doubles it can do). Earning 10% your money will double every ~7 years. This is where the money you saved (didn’t spend) starts to earn you more money without you having to work (best side hustle ever!).

#4 - Minimize DEBT

AVOID all debt except mortgage debt. Pay down any debt as quickly as possible. Debt is a commitment of future earnings (less optionality)! Any interest expense you pay monthly is money that can't be spent on food, clothing, and vacations!

You either pay or receive interest! If you have consumer debt (car loans, credit cards, etc.), calculate how much you are paying monthly in interest to banks and look to reduce that number over time.

You should review the 8 levels of financial independence. If you are in your 20s or 30s, you can fast track to level 6 simply by avoiding common consumer debt at the beginning of your journey.

#5) SPEND intentionally and enjoy life!

Life and money are not about deprivation. Align spending to your individual and family values. Spend time scrutinizing the big purchases (home, car, school, etc.) and don't sweat the small things. Focus on experiences and minimize big lifestyle upgrades as your income increases.

What is the meaning behind Ten Wilsons?

The $100,000 bill is the highest denomination ever issued by the U.S. Federal Government. Woodrow Wilson is the president on the $100,000 bill.

In theory, if you had 1 of these $100,000 ‘Wilson’ bills you would have $100,000 net worth. If you had 2 Wilsons you would have a $200,000 net worth. Therefore, if you had 10 Wilsons you would have a $1 million net worth. Therefore TenWilsons = Millionaire

Looking for more TenWilsons content?

We will also be providing new personal financial metrics that you won’t see elsewhere (example: net worth composition analysis: % of net worth in home equity vs retirement accounts at various ages; the 8 levels of financial independence; data of visible vs non-visible wealth). We also recently started doing data visualizations to help turn data into interesting charts and interactive stories. Follow TenWilsons on twitter where you can get daily content and other helpful financial tips.

Feedback or comments?

We want your feedback! What did you think of this week’s net worth updates? Do you have any advice you’d like to provide others in their 20s/30s?

Also, please provide your feedback and comments on what information or segments you like most and what you would like to see more of. Thanks!

This is a beautifully conceived and executed newsletter -- unlike anything else out there. Hope you will continue to include net worth stories of people in their 40s and above.