The 8 levels of financial independence - What level are you at now? What age did you reach various levels?

Detailed levels described based upon your type of financial accounts (checking, savings, 401(k), IRAs, taxable brokerage, home) and your level of debt.

Progressing through the financial levels likely requires a shift in your financial habits and overall thinking around money. The first step is taking stock of your financial situation by calculating your net worth — this is how much in assets you have and how much you owe.

Why is net worth important? Many think it’s all about achieving a high income. The problem is many increase their spending as their income increases and still live paycheck to paycheck. Net worth only increases from the earnings you have that you don’t spend. Income is one factor in growing your net worth but more important than earnings is your savings rate, your lifestyle and financial choices.

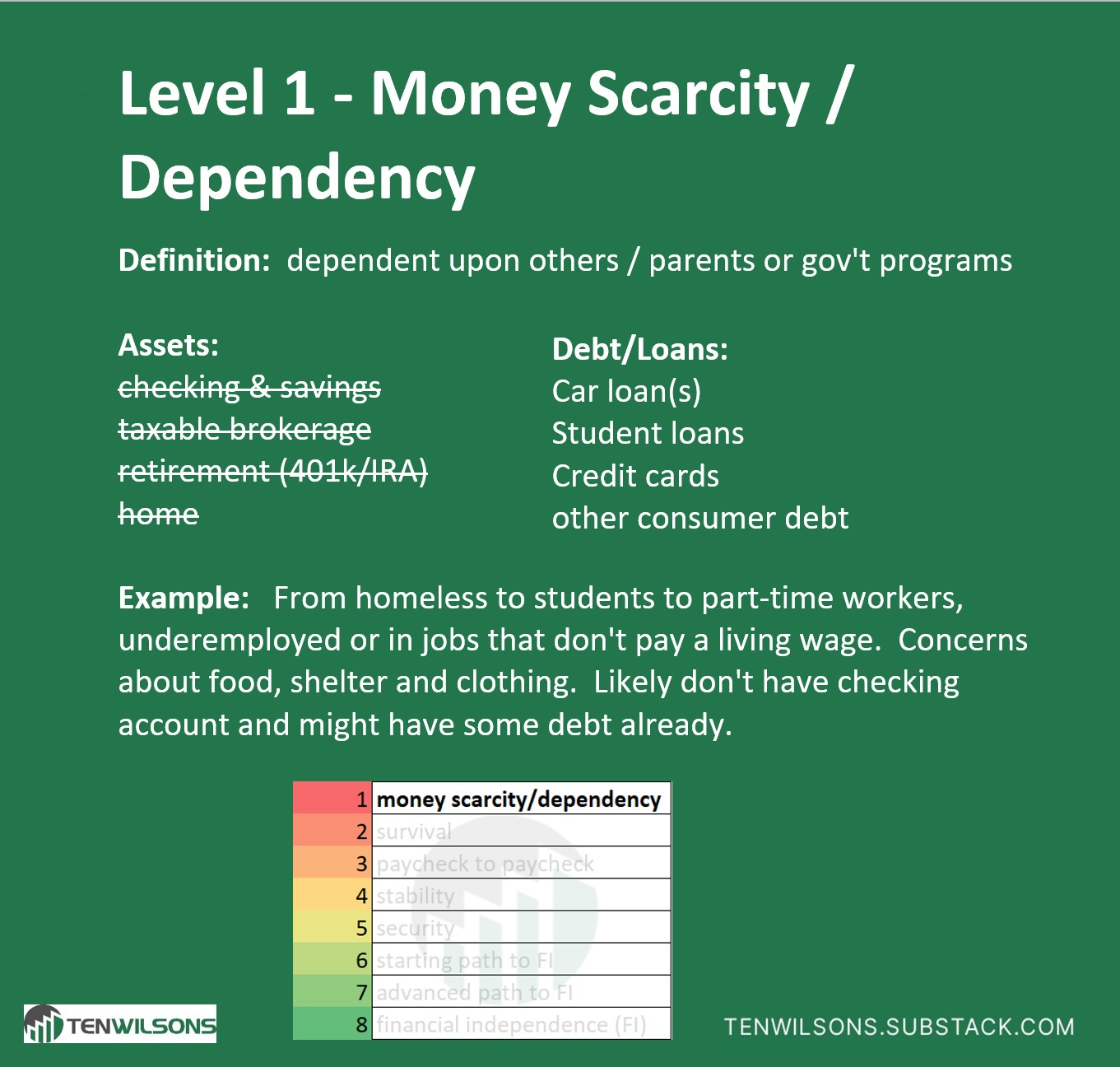

Level 1

Everyone starts off here (well except those with the silver spoons or a trust fund). We all start off dependent on our parents. The goal for most is to become independent and be able to provide for ourselves.

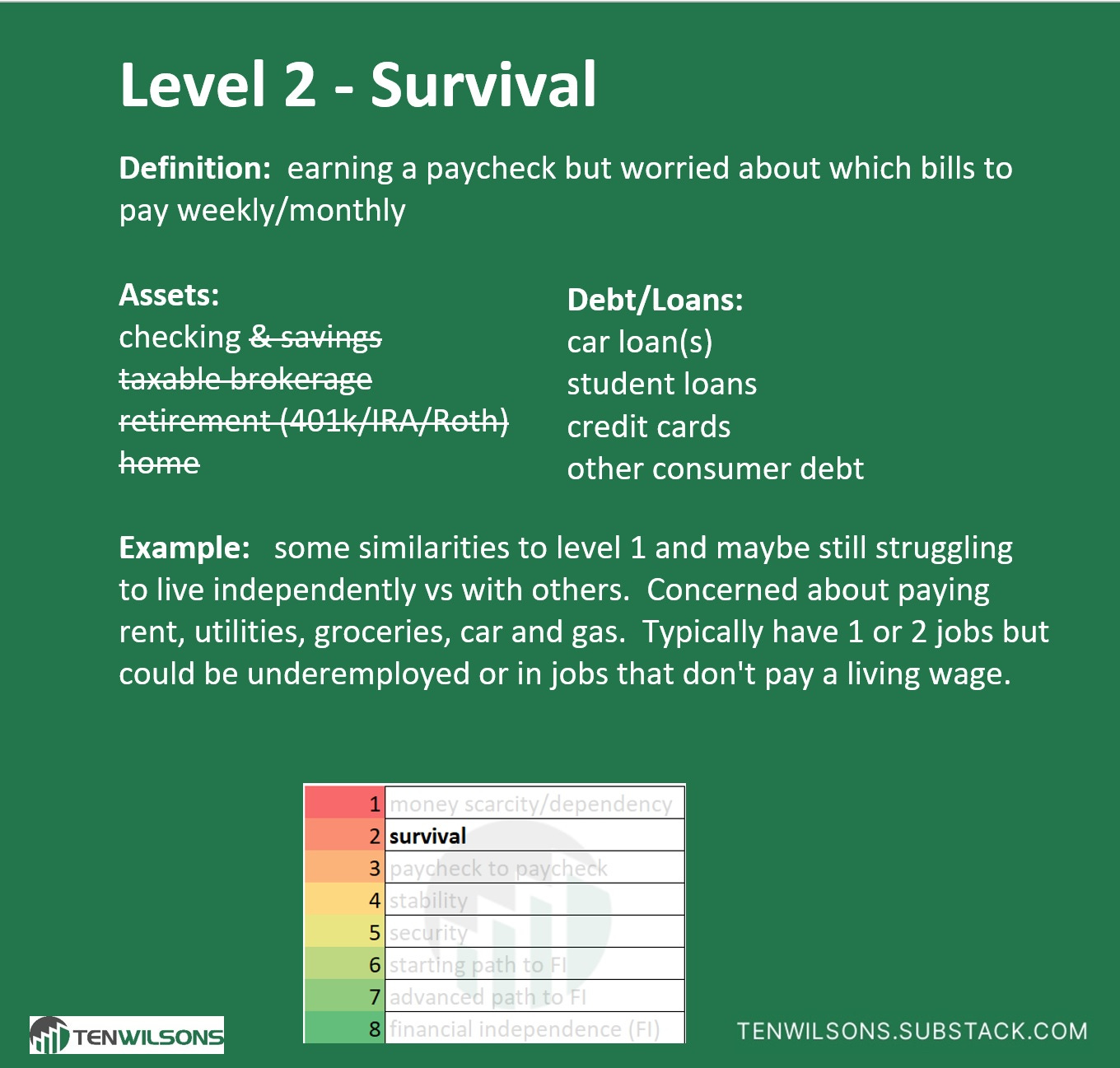

Level 2

At this level, you are earnings a paycheck but worried about which bills you are going to pay weekly or monthly. There are some similarities to level 1 and maybe you are still struggling to live independently versus with others. There are definite concerns about just paying for rent, utilities, groceries and having reliable transportation (i.e. car and gas). At this level, you are now in the banking system and have a checking account (NOTE: There are 7 million households in the US that don’t even have a checking account).

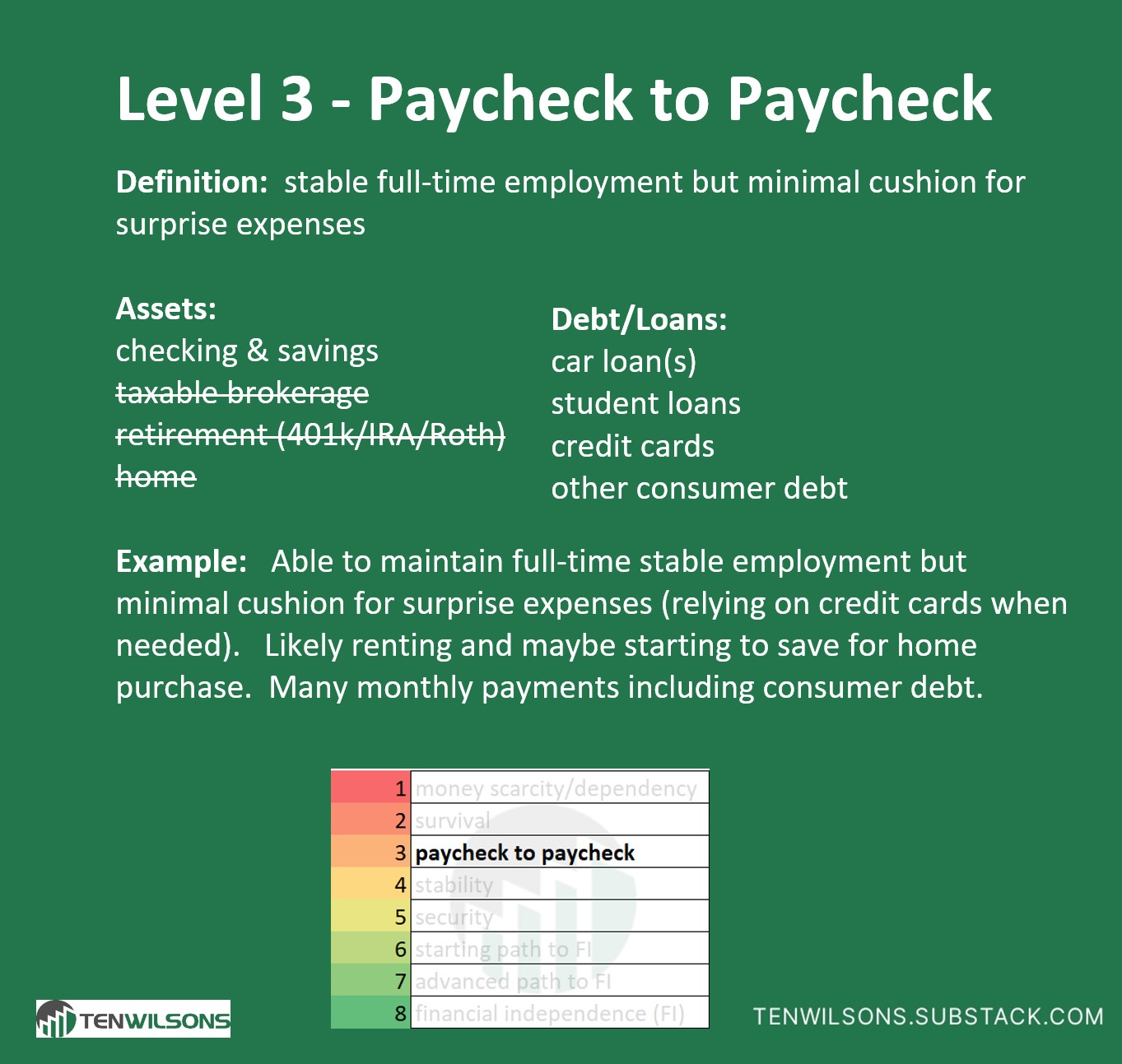

Level 3

Reaching level 3 is being able to maintain full-time stable employment. However, you likely have a savings account but maintaining enough cushion for surprise events can be challenging. When those surprise events happen, it could require the use or reliance on credit cards. Typically, at this point, one is not yet focused on saving for the future and is still focused on making monthly payments which could include various types of consumer debt.

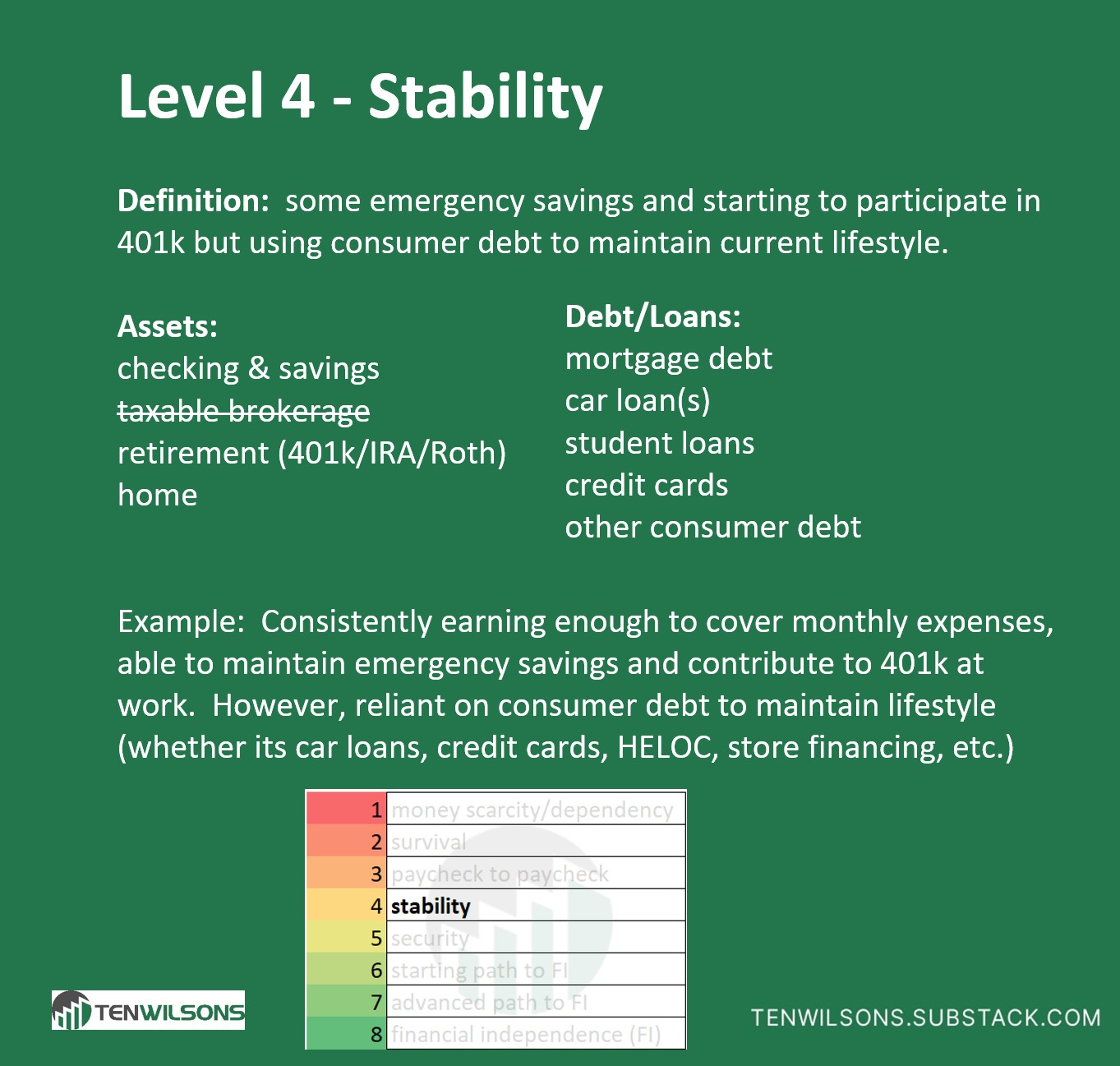

Level 4

This level starts to expand savings (both emergency savings and retirement savings). Typically, participating in employers 401(k) plans. Home ownership starts at this level - one possibly saved for the down payment and then purchased a home with a mortgage. This level also uses other consumer debt to maintain lifestyle (car loans, HELOC, store financing, etc.). Many get stuck at this level due to use of consumer debt which is effectively committing future income for today’s enjoyment.

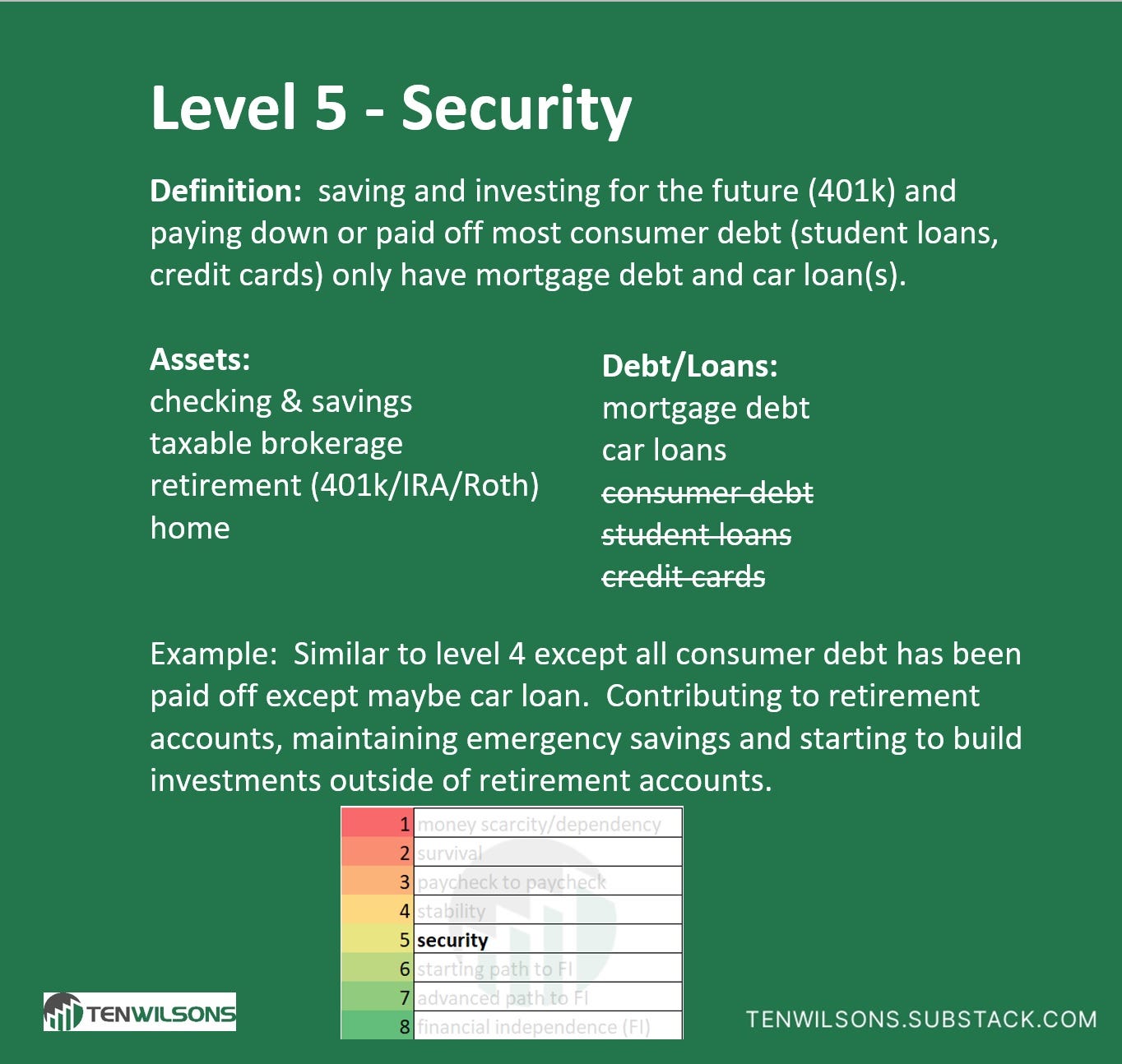

Level 5

Level 5 has increased focus on saving and investing for the future, beyond a 401(k). This could be opening up a self-directed taxable brokerage account and buying ETFs or individual stocks. In addition, you focused on elimination of student loans, credit card debt and any other consumer debt (except car loan).

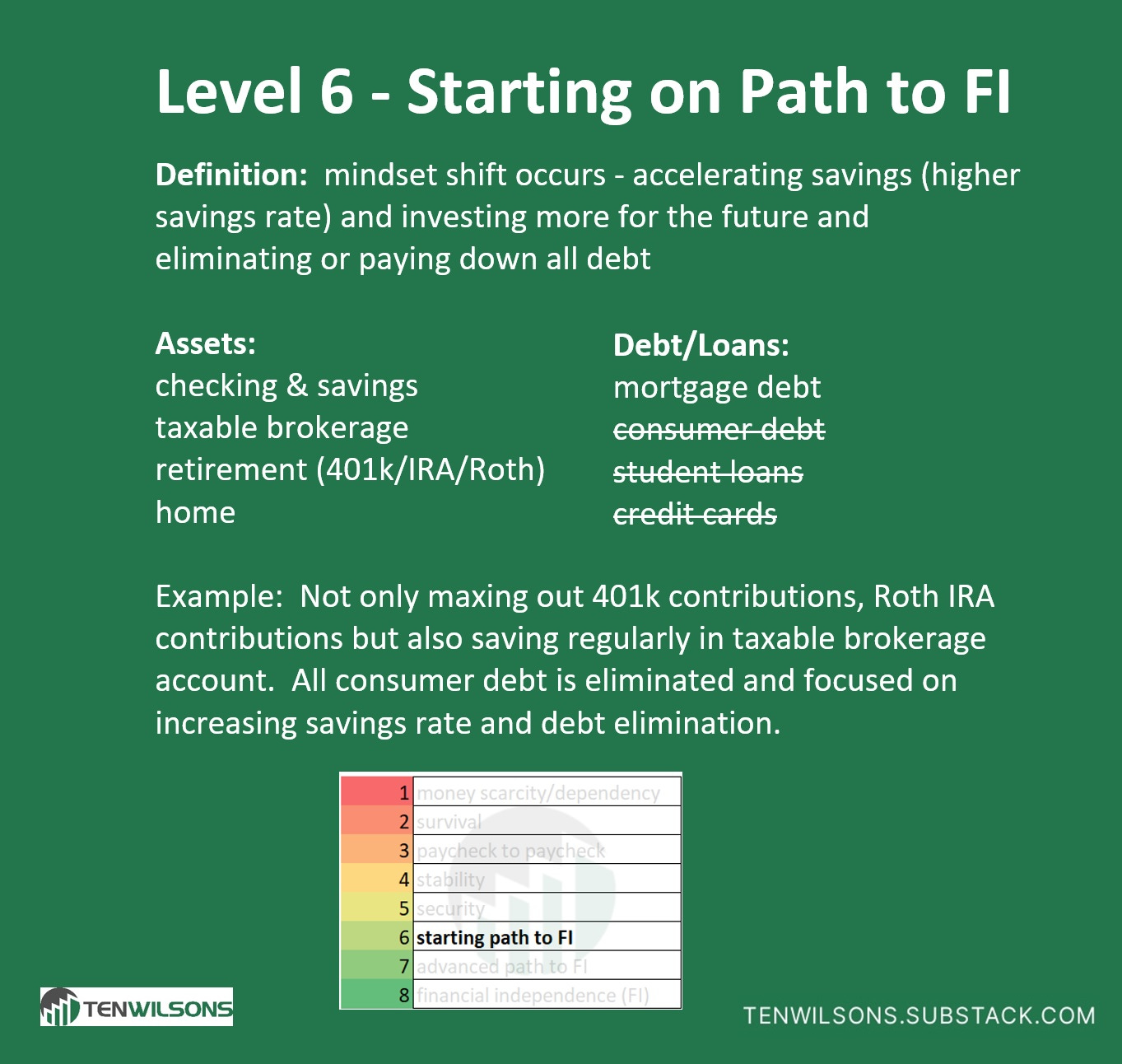

Level 6

Level 6 involves a mindset shift. Not only would you be debt free (except for only a mortgage), but you are focused on using your increasing earnings to increase your savings rate (by limiting lifestyle inflation). If you are in your 20s or 30s, you can fast track to here by avoiding common consumer debt at the beginning of your journey.

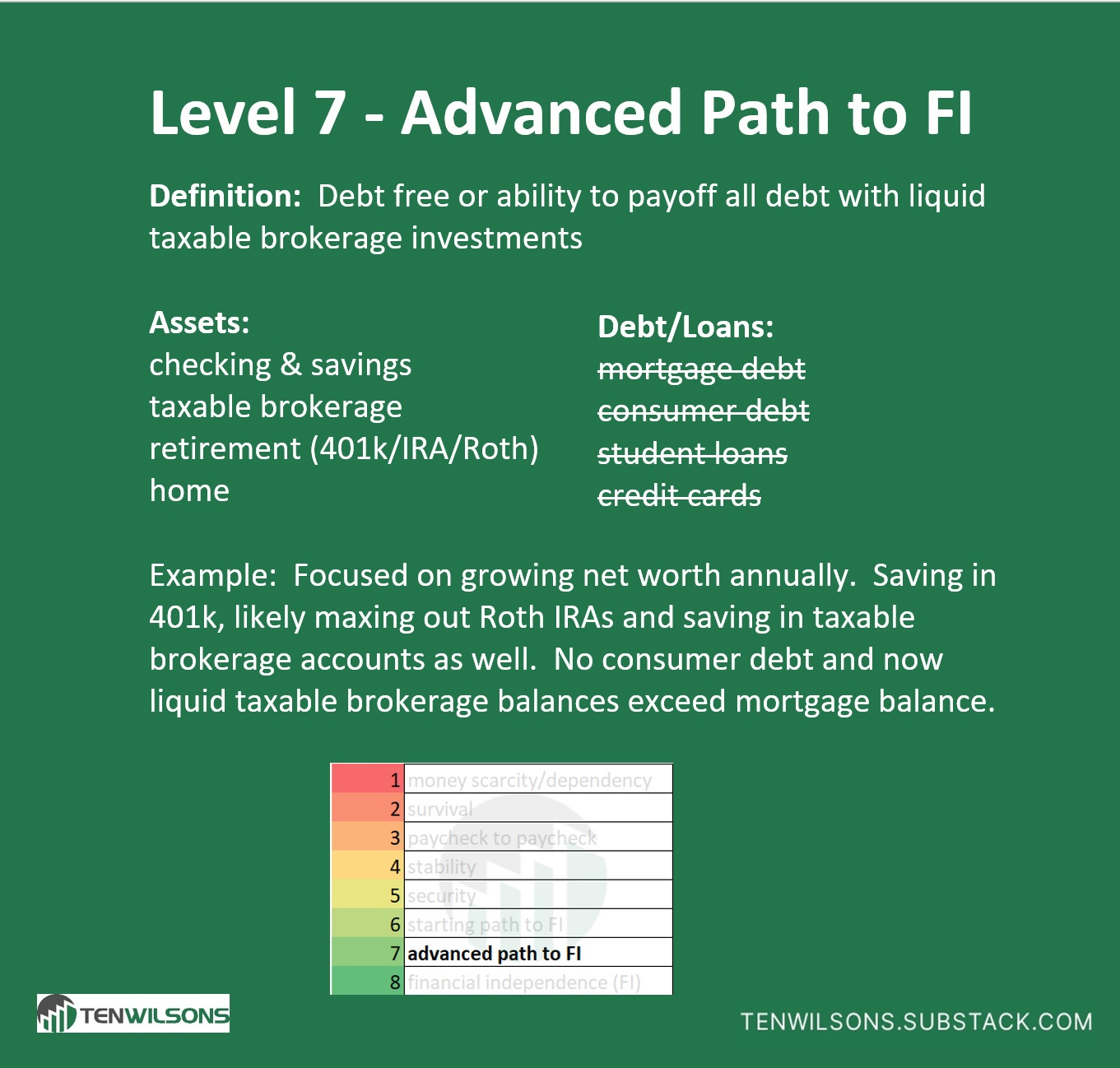

Level 7

Level 7 is when you have not only growing retirement savings 401(k) balances but also you have been growing your taxable brokerage assets. At this point, you are either debt free or your taxable brokerage balances exceed your mortgage balance. It is typical at this level that 401(k)/IRA balances significantly exceed taxable brokerage balances or home equity as well.

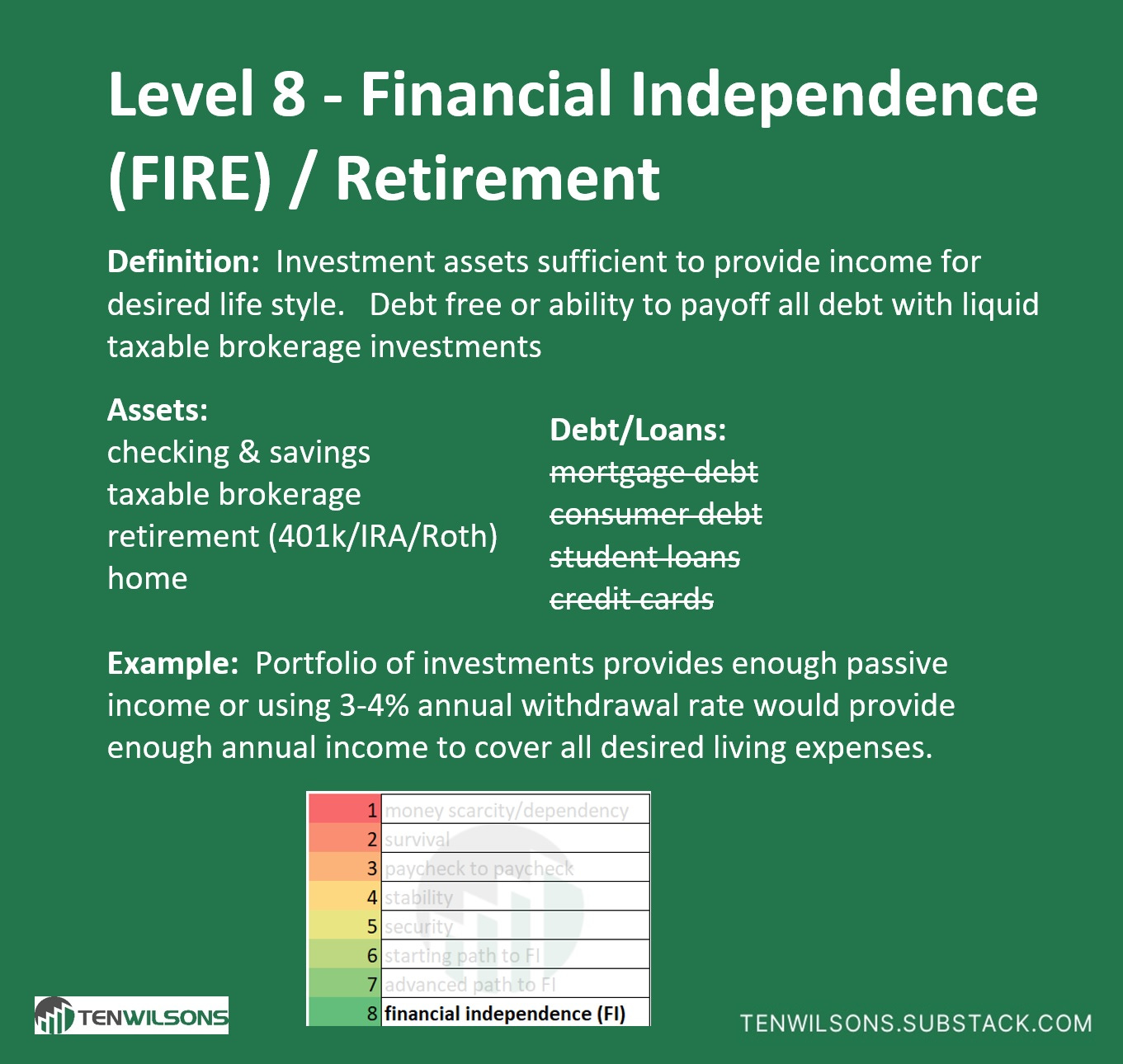

Level 8

Level 8 is achieved when you have sufficient assets to provide income for your desired lifestyle without working. It typically means you can live on passive income, pension income, social security income and/or 3-4% withdrawals of your investment assets.

Examples:

$100k annual spending requires $2.5 to $3.3M in investment assets + paid off house $200k annual spending requires $5 to $6.7M in investment assets + paid off house

By following these 3 proven principles (EARN - SAVE - INVEST) you can achieve financial independence. Follow along on Twitter (@TenWilsons) or subscribe to our Saturday morning weekly substack report where we provide the details on many different paths net worth progressions that those in their 20s, 30s, and 40s took to achieve financial independence.