Weekly Summary: 20 Net Worth Updates from all over the internet. What is TenWilsons? What is the median Net Worth by Age in the U.S.?

Net worth updates: military officer, lawyer, blogger, programmer, radiologist, accountant, and many others...

Weekly Summary - Net Worth Updates:

Each week, TenWilsons will publish two articles. First, on Wednesday, will be a detailed ‘net worth’ story chosen from thousands of net worth progressions on NetworthShare.com. Second, on Saturday, will be a weekly summary that is curated from reviewing hundreds of articles, personal finance blogs, and social network updates to find net worth updates posted in the last week. This week we have 20 different net worth updates / stories. These are net worth updates from ordinary people in various professions, ages and stages of building wealth. Some have just started their careers, some are close to financial independence and others are already retired.

The goal of TenWilsons and NetworthShare collectively is to provide the tools and community to educate and motivate others to make more "informed" or "intentional" financial decisions and minimize the use of consumer debt

We hope you find these stories inspirational. They say the best learning is finding, watching and learning from those that are just ahead of you. We hope you use this information to make more informed financial decisions and create the life you want. Maybe you have been tracking your net worth for 10 or 15 years or maybe you just found this site and are calculating your net worth for the first time. Either way, talking about finances with others is not easy, in fact, it is often considered taboo in our society. Therefore, this is a community where anonymously you can share and celebrate your financial milestones! So much of our society is focused on visible wealth (homes, cars, vacations, etc.) but as you will see for those that are trying to build wealth, most of it is not visible (it’s in a 401(k), a brokerage or a bank account).

Click on any of the net worth numbers below for a link to the source of the information. See you next week!

20s:

$298,347 [NetworthShare] - age 29 - accountant - he achieved his first $100K of savings was at the age of 26 - This is our ‘net worth’ story of the week (see full story link below) - includes 5 proven ways to build wealth starting in your 20s or 30s

The story of a 29 year old achieving a $300K net worth. 5 year history shows all the financial details.

Net Worth Stories: Every Wednesday, we focus on a net worth “story” to help you peek inside someone’s personal finances and get the inside view that nobody usually talks about. This week we have a 29 year old accountant with a masters degree that is now earning between $90-$100K/year.

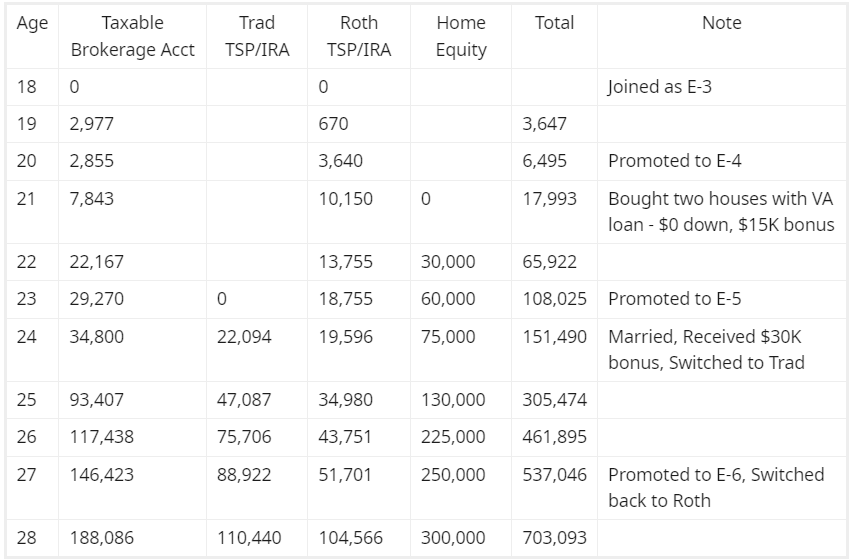

$703,903 [Reddit] - age 28 - married no kids - finishing 10 years in the military - started at $0 net worth at 18 years old - see below chart documenting the journey - bought 2 homes with VA loans and rented them out at age 21 (2017) - Plan is for 2-3 kids and to retire from military at around age 38-42 as an O-4, with a $4,000/month pension for life

30s:

$486,613 [NetworthShare] - age 35 - spent the beginning of his career as a programmer in the software industry, but was experiencing burnout - now starting a company with the goal of creating a profitable business - 55% of net worth is in retirement accounts and 36% of net worth is in home equity

$690,000 [Bogleheads] - age 39 - married with 3 kids - over 400 posts about various financial topics including various net worth milestones, home improvements, vacations, job promotions, etc.

$771,000 [Bogleheads] - age 33 - married and 2 kids - 63 posts in the last 5 years - many discussions on vacations, high mileage cars/buying a new car, and renovating vs buying new home

$1,000,000+ [Business Insider] - age 34 - married and no kids - traveled to all 61 national parks over 7 months in 2019 - became millionaires on 5 figure salaries - owned home in Florida that they use as rental investment property now - running the blog Trip of a Lifestyle

$1,014,500 [Reddit] - age 36 - married - started saving at age 22 earning $50K as federal government employee - Reached millionaire milestone this month! - graduated debt free from ivy league school (alma matter subsidized 90% from endowment) - high savings rate as a U.S. government employee stationed overseas for 10 of the last 14 years (free housing) - 57% of net worth is in retirement accounts - also eligible for $86K/year pension at 50 years old plus subsidized health insurance premiums

$1,200,000 [Millionaires Unveiled] - age 30 - former software engineer - got lucky with equity from startup and became millionaire in his 20s - currently on sabbatical / mini-retirement - living as a nomad traveling the world for the last 4 years - net worth breakdown $100K in crypto, $500K in index funds and $500K in individual stocks - investments growing faster than withdrawals

$1,800,000 [Bogleheads] - age 36 - radiologist - finished fellowship in 2019 (age 32) - continuing to live like a resident and savings/investing aggressively - crossed $1 million net worth at age 35

$2,005,384 [NetworthShare] - age 39 - this week became multi-millionaires crossing $2 million threshold - 14 years of net worth history starting in 2010 at $96,251 net worth

40s:

$535,548 [NetworthShare] - age 40 - single - military officer - recently paused contributions to his retirement plan - no debt - $5K car - retirement balances make up 95% of net worth - plus eligible for $5K/month retirement pension in 5 years

$1,600,000 [Reddit] - age 40 - single and living in Vietnam as an American expat for a multinational corporation. Planning to retire in Thailand within the next 5 years on $40K/year USD equivalent

$1,850,000 [Reddit] - age 40 - married and living in Toronto - currently double income and no kids but hoping to have kids shortly - own 4 rental investment properties in Toronto - first job post graduation was $55K but now she earns $300K+ including bonus and partner earns $150K including bonus.

$2,300,000 [Reddit] - age 40 - partner but unmarried - graduated in 2006 with negative net worth of ($20K) and a first job earning $40K salary + $5K bonus - shows earning progression from 2006-2024 and net worth progression from 2006-2024

$2,400,000 [ESI Money] - age 46 - married with 2 kids - individual contributor as an enterprise data governance specialist and husband is an IT engineer - currently saving 61% of their take home pay - 46% of their net worth is in their work 401(k)s - they each earn about $150K and spending is about $95K/year.

$8,200,000 [Reddit] - late 40s - social scientist who worked for both small and large tech companies - started having interest in bitcoin in 2013 - sold $1.5M bitcoin in 2017 and was going to take a 1 year sabbatical - 6 years later is basically retired early (FI/RE) - provides detailed annual updates the last 5 years - has remained invested in tech and bitcoin and has experienced lots of volatility in net worth over the last 5-6 years

50s/60s:

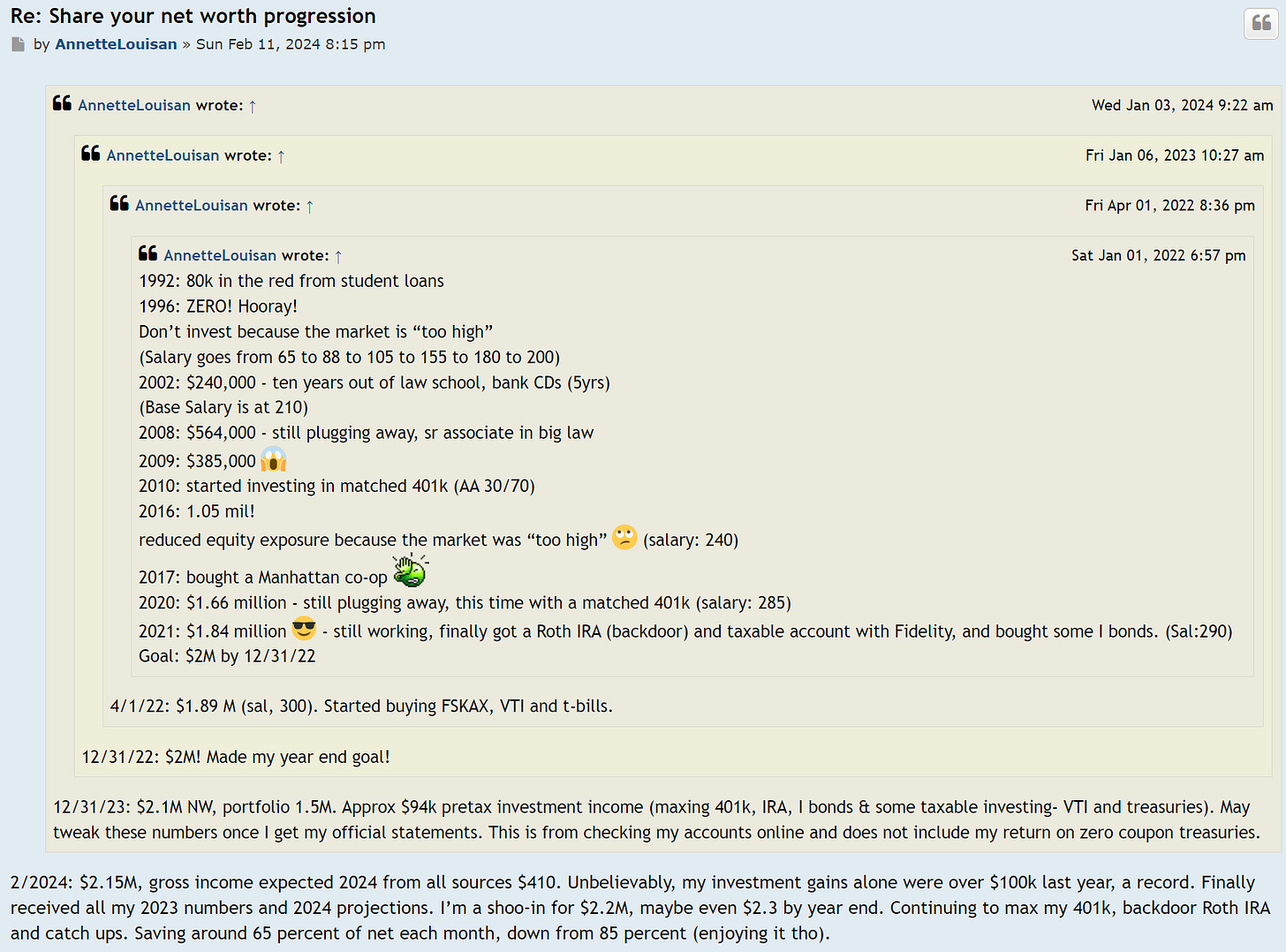

$2,150,000 [Bogleheads] - age 53 - lawyer that started with a negative ($80,000) net worth in 1992.

$5,227,000 [ESI Money] - age 55 - married with 3 kids - 20 year C-suite executive in hospital administration - owns 3 duplex rental properties and a $1 million beach house (no mortgage) - recent financial interview as well as an interview in 2017 when their net worth was $2.23 million - Goal is to retire at either age 59-60

$6,767,000 [ESI Money] - age 59 - married with 2 kids - retired at 52 - In December 2022, they moved from Colorado to the Villages retirement community in Florida - owner of esimoney.com blog - long recent interview as well as an interview from 2018 when their net worth was $3.78 million

$9,500,000 [Reddit] - age 50 - planning to retire in a few months and initially live on ~2% withdrawals - current investment allocation is 87% equities and 13% cash/t-bills, no debt and $1.4 million house - net worth was $5.6 million 3 years ago

Are you wondering what is the meaning behind Ten Wilsons?

The $100,000 bill is the highest denomination ever issued by the U.S. Federal Government. Woodrow Wilson is the president on the $100,000 bill.

If theory, if you had 1 of these $100,000 ‘Wilson’ bills you would have $100,000 net worth. If you had 2 Wilsons you would have a $200,000 net worth. Therefore, if you had 10 Wilsons you would have a $1 million net worth. Therefore TenWilsons = Millionaire

Over time, we will be providing content specific to various life stages as well as celebrating those that achieve various financial milestones starting with OneWilson because saving your first $100K is the hardest!

Our weekly net worth story in case you missed it!

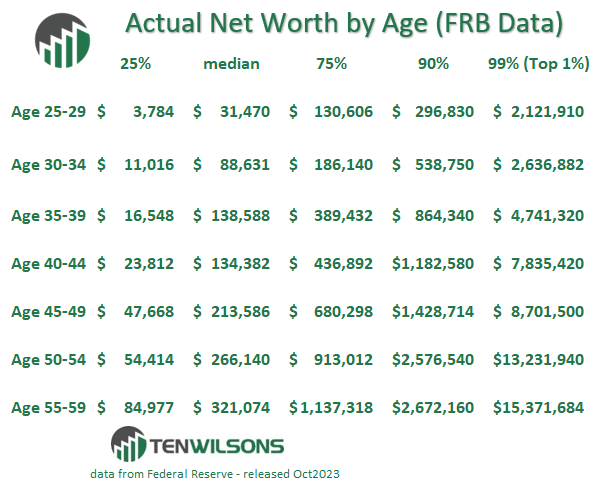

Where do you stack up?

Below is the median and various percentile net worth information from a recent Federal Reserve Bank survey. We provide this not to create envy of those that have more, but simply as a benchmark. FACT: 93% of equities are owned by those in the 90th percentile+, so if you want to be build wealth, working toward that column over time should be your target based upon your age.

Looking for more TenWilsons content?

We will also be providing new personal financial metrics that you won’t see elsewhere (example: net worth composition analysis: % of net worth in home equity vs retirement accounts at various ages; the 8 levels of financial independence; data of visible vs non-visible wealth). We also recently started doing data visualizations to help turn data into interesting charts and interactive stories. Follow TenWilsons on twitter where you can get daily content and other helpful financial tips.

Feedback or comments?

We want your feedback! Please provide feedback/comments on what information or segments you like most and what you would like to see more of. Thanks!