Unique career path to $3 million net worth on a Caribbean island.

19 net worth updates from ordinary people building wealth.

Weekly Summary - Net Worth Updates:

Each week, TenWilsons will publish two articles. First, on Wednesday, is one long-form detailed ‘net worth’ story. Second, on Saturday, is a weekly summary that is curated from reviewing hundreds of articles, personal finance blogs, and social network updates to find net worth updates posted in the last week.

This week we have 19 new net worth updates / stories. These are net worth updates from ordinary people in various professions and at different stages of building wealth. Most started from $0 net worth or a negative net worth due to student loans.

We have several net worth updates from those in their 20s/30s that are just reaching their first $100K in net worth. There are also 9 multi-millionaires that are not doctors, lawyers or business owners. They all seem to use utilize many of the 5 proven ways to build wealth. There are some great examples on how to effectively set and use financial goals. There are several that are close to achieving an early retirement but are worried they might not have “enough”. Also, discussions on enjoying life by having balance between intentional spending and saving for tomorrow.

The goal of TenWilsons and NetworthShare collectively is to provide the tools and community to educate and motivate others to make more "informed" or "intentional" financial decisions and minimize the use of consumer debt

Sometimes the best opportunity for individual growth is by finding, watching, and learning from those that are just ahead of you. We hope you use these stories to make more informed financial decisions and create the life you want. Maybe you have been tracking your net worth for years or maybe you just found this site and are calculating your net worth for the first time. Either way, talking about finances with others is not easy, in fact, it is often considered taboo in our society. Therefore, this is a community where anonymously you can share and celebrate your financial milestones! So much of our society is focused on visible wealth (homes, cars, vacations, etc.) but as you will see for those that are trying to build wealth, most of it is not visible (it’s in a 401(k), brokerage, or bank account).

Each of these short net worth updates are teasers of their net worth stories. We try to highlight 1 or 2 takeaways, anecdotes or ideas that will hopefully inspire you (to conquer debt, save for retirement, etc.). Click on any of the net worth numbers below for a link to the source of the information. See you next week!

20s:

$104,567 - age 26 - single - income increased 8% in 1 year - net worth increased from $57K to $105K in 1 year. After graduation, started making significant contributions to 401(k), Roth and HSA plans

$250,000 - age 25 - single - living at home - steady increase in income - saving but also enjoying his 20s and sharing experiences with family/friends. “I’ve always tried to be smart with my money while also balancing the idea of “living life” based on what I heard from others….I work from home and I’m fortunate enough that my relationship with my parents is really good. It allows me to save a LOT in rent for now…I plan on moving out in the next year or two, but until then, I’m just going to build up as much as I can. I also treat my family/friends when I can with food/experiences…”

$300,000 - age 28 - single - shares timeline to reach first $100K (3.5 years) as well as subsequent $100K increments. “Well, going from 200k to 300k certainly felt quicker than I imagined.”

30s:

$100,000 - age 34 - divorced - no children - lives and works in Bogota, Columbia - shares excitement on achieving first $100K in net worth - “I feel so happy to have accomplished this goal. Especially while being an employee, and not being born in the USA or in Europe, without English being my native language, and after having gone through a divorce where I had to pay all the legal fees and lost property.”

$155,000 - age 30 - started with negative net worth with student loans - now starting to build wealth and set their own financial goals - “At 26 years old I graduated college with an engineering degree and my net worth was -15k with student loans. In just over 4 years, I have been able to turn the tables and get myself in a position to have a bit of a breathing room. Growing up quite poor from immigrant parents, I made a promise to myself never to feel financially inadequate ever again.”

$579,000 - age 33 - married - saving is important but its also important to ensure you are enjoying life and not letting fear of not having ‘enough’ impact your relationship or certain life milestones like buying a house - “My wife and I are house hunting and I'm having a really hard time with it. We relocated two years ago and have been renting. She wants a home, but I'm having a really hard time letting go of the cash and I am not enjoying the process at all. She is excited, and I'm an anxious mess.”

A$714,000 - age 30s - she is a doctor in Melbourne, Australia. Started a blog in July 2020 about her personal journey to financial independence (FI/RE) and is on twitter under ChasingFir. Her financial goal at this point is ~$3 million - “My goal is to attain a level of financial independence so that work is optional by the time I’m 50, though I don’t intend to fully retire.”

$3,000,000 - age 39 - married with 2 kids - very unique path to building wealth - Lived rent free managing a family’s estate on a Caribbean island - bought a small hotel in Colorado tourist town during the Pandemic on a fire sale - lived at hotel for 18 months with family - created a few other side gigs - he didn’t graduate college, lived on a Caribbean island for 1/3 of his adult life and now has business on autopilot that earns $300K annual income. Here is what he attributes to their success - “(1) Being willing to think outside of the box. Door to door sales absolutely sucks but I wouldn’t be here now without that experience. Also living rent free for 7 years was a huge advantage and it’s possible for anyone. There are websites and job forums dedicated to lifestyle jobs like that. Many of them allow one half of the couple to hold a regular job. (2) We weren’t afraid to take risks. I try to just do the opposite of whatever the current news cycle is saying I should do. It has served me well. (3) I learned how to sell early on. Being able to communicate and negotiate comes in handy every single day no matter what industry you’re in. The skills I needed to be a good salesman have also helped me with interpersonal relationships. (4) Last but not least, luck. I had good sales managers (lots of people fail in sales because of lack of training), great timing on buying a house in 2009, and even better timing on buying the hotel in a pandemic.”

$3,300,000 - age 37 - married with a 7 year old daughter - was laid off last October - considering early retirement if they can get their side gig which is currently generating $40-50K to $100K/year. Take-away: there are many career options that can build you wealth and you don’t have to be a software engineer - “My career was in, of all things, customer service...started as a customer support agent and worked my way up into management. Point being, I see a lot of super technical types here and others responding "but I can't do that." You don't need to be a software engineer or a CEO. You can make it with a wide variety of career options.”

40s:

$605,000 - age 40 - single - earning $105K annually - 81% of net worth is in 401(k) - contributes $15K annually to 401(k) + company match. She also has a side gig earning $1,500/ month.

$969,000 - age 45 - almost at $1M net worth - starting to think about early retirement in 5-10 years in a lower cost of living location - “I plan to move to a lower cost of living city, maybe down in Florida or go abroad, think Thailand, Portugal, Latin America, etc.”

$1,400,000 - age 43 - employed in the military - has $580K in TSP (Thrift Savings Plan which similar to 401(k) for government employees) - $711K in equity in investment real estate. Other military benefits - free family medical, kids get free college/stipend (joining the military also) and also eligible for $1,200/month pension at 55

$2,200,000 - age 43 - married - 2 kids - live in Southern California ($850K equity in a $1.4 million house) - $1.35 million in invested assets - they started to save and invest at age 22 - “Started investing in Roth IRA at 22 after hearing if I put in the $2000 max per year (at the time) for 5 years it would be $1M by the time I retired. Invest early and often!”

$2,380,000 - age 40 - married - $740K in home equity and $1.64 million in assets invested - track your net worth and let time and compounding build your wealth

50s:

$2,400,000 - age 55 - focused on investment real estate (50% of net worth) - here is a look at the details - “Investment Properties: SFH Investment Properties: $1.2M (net of mortgages). These are 10 long term single family rentals in 5 cities across 3 states and are a mix of ones I own by myself and others where I'm a part owner. The ones I own generate net 50k per year in income (after mgmt fees, insurance, taxes, and 10% to cover vacancies/capex). Most of these have had roof and hvac replaced within the last 2 to 7 years.”

$3,800,000 - age 57 - married - newly retired in March 2024! 25 years in a corporate position and then 2 years consulting before walking away - he provides inspirational words for your own early retirement - “Stay the course, keep working the plan, it will happen for you.”

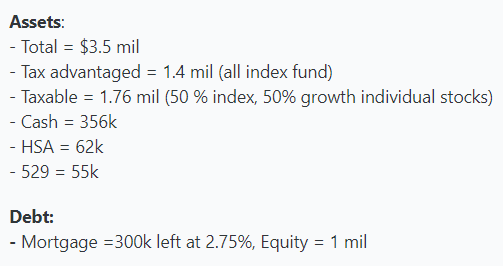

$4,500,000 - age 50 - married with 2 kids - $3.5 million invested and $1 million in home equity - starting to think about early retirement - “My job has been highly stressful for the last year or so and I dread getting up in the morning to deal with firefighting. I have been wanting to call it quit, but have been unable to. I think the big part of the reason is I am very risk averse and afraid of financial failure.”

60s:

$3,079,000 - age 62 - married with 5 kids - long form year-end 2023 interview which was an update from a 2020 interview - first job was in the military earning $21K - then he joined a Fortune 25 financial services company in construction management in the corporate real estate department (niche specialty area that leveraged his graduate engineering education and technical and leadership expertise gained in my military career) - follow the 5 proven ways to build wealth - “We grew the gap between our income and expenses, and then saved and invested that money consistently over many years.. we were really good about minimizing debt…”

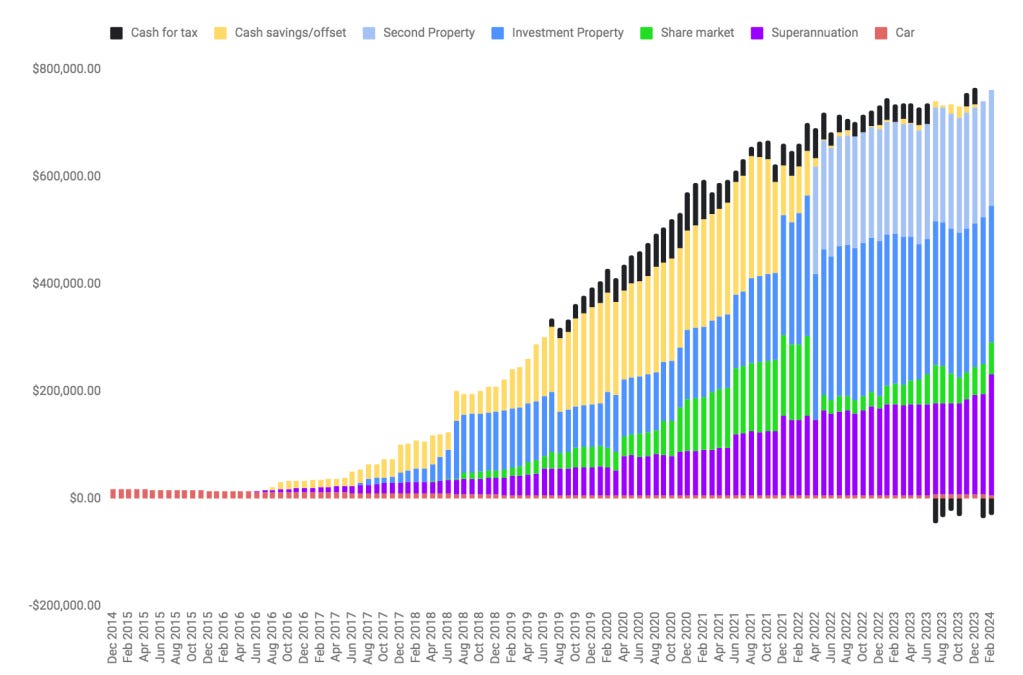

$5,203,094 - age 66 - 25 year net worth history going back to the year 2000 - phasing into retirement - has 3 primary financial goals - “In 2024 I am only going to work 1 day a week. I'm working for my former partner who bought out our interest from me on a 10 contract at the end of 2023. So I've finally got a free moment to try and clean up the mess that have been my investment accounts. I've got three goals: 1) Be responsible with the funds that I've accumulated 2) Simplify my accounts and 3) Ensure that I can weather the unforeseen.”

What is the meaning behind Ten Wilsons?

The $100,000 bill is the highest denomination ever issued by the U.S. Federal Government. Woodrow Wilson is the president on the $100,000 bill.

In theory, if you had 1 of these $100,000 ‘Wilson’ bills you would have $100,000 net worth. If you had 2 Wilsons you would have a $200,000 net worth. Therefore, if you had 10 Wilsons you would have a $1 million net worth. Therefore TenWilsons = Millionaire

Looking for more TenWilsons content?

Follow TenWilsons on twitter where you can get daily content and other helpful financial tips.

Please like and share with others!

If you enjoyed this article, please press the like button (at the top or bottom) and consider sharing it with others!