Epic 20 year financial journey to a $3 million net worth. 5 take-aways to inspire your own financial goals.

20 years of net worth history and 80 blog posts

Net Worth Stories:

Every Wednesday, we focus on a net worth “story” to help you peek inside someone’s personal finances and get the inside view that nobody usually talks about. This week we have a 47 year old that is married with kids. He lives in a VHCOL area and has a household income of $200-250K/annually.

He has over 200 monthly net worth entries on networthshare.com as well as over 80 posts on his own blog site debt sucks! This provides incredible insight into life events and financial decisions as they happened. We’ll highlight some of the detailed financial decisions, setbacks, and milestones into his financial journal to multi-millionaire status (net worth is currently $2.95 million as of February 2024). We hope you can relate to something about his financial journey and we hope you are inspired to set your own financial goals. Enjoy!

2004 (age 27) - starts tracking net worth

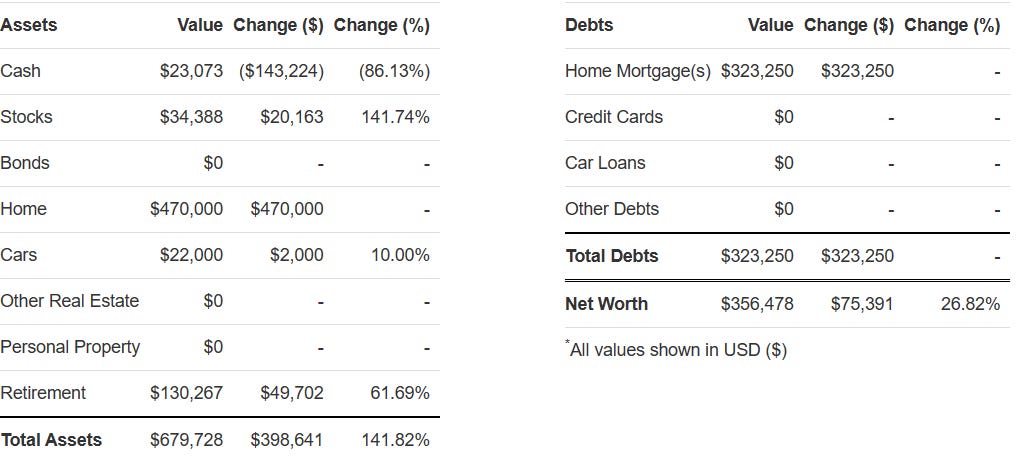

We have 20 years of net worth history going back to 2004 (age 27) when he was single and living in a condo. The majority of his net worth at that time was in home equity (57%) and 401(k) at work (26%).

2007 (age 30) - moves into new condo - sets first financial milestone goal - budgeting for home and car repairs - saving for a wedding

In February 2007 (age 30), he recently moved into a new condo that was slightly more expensive and now has a higher mortgage balance. He sets one of his first financial goals to become a millionaire in 10 years (at age 40). At this time, his salary is ~$90,000 and the majority of his net worth is still in home equity (41%) and 401(k) at work (36%).

“I've set an optimistic goal of 2mil by the time I'm 40. It's optimistic but not unobtainable (a very realistic goal would be 1 mil).”

I think it’s also interesting to see what is was like for a multi-millionaire before when they were single and not yet a millionaire. This was an entry at the end of 2007 which shows he had to budget for things like home and car repairs.

“The first half of 08 will not be a good savings period, I have several major purchases coming: 1) Appliances and other home upgrades to prep home for sale. Budget 6500-8500. 2) Car repair (car needs body work, some of it is covered by insurance, other will be out of pocket) 3) A misc 7500 expense, plus another few expenses associated with that...”

2008 (age 31) - A wedding and a recession shows some things you can plan for and some things you can’t!

Retirement account peaks at $172,766 in May 2008 and decreases to $118,401 by October 2008. That’s a 31% decrease in 5 months. He gets married in December 2008 and they are preparing his condo for sale in 2009. Here was his net worth composition and market thoughts in October 2008 (market bottom).

“I think there is enough panic right now, and negativity, that it's probably time to start buying. I've been calling a low to the S&P at around here... might go a little lower. What to buy.... stay away from broad based indexes. Quality company, with good overseas exposure. I still think the recession will last longer in the states than it will overseas (after all, we started the whole problem, we are the contagion this time). Anyhow, it sucks seeing your net worth dive like this, but I must get back on the horse and make some bold moves here.”

2009 (age 32) - sells condo - gets a raise - planning to buy a new home home in 2010 - expecting first child in 2010

“Condo Sold... too much cash, need to figure out what to do with it until we buy again.”

“Passed the 150K mark in salary, very happy I am where I am at. Even though the stress gets to me at times. More than likely we will be renting in the very near future after a brief stop at storage and the in-laws for now”

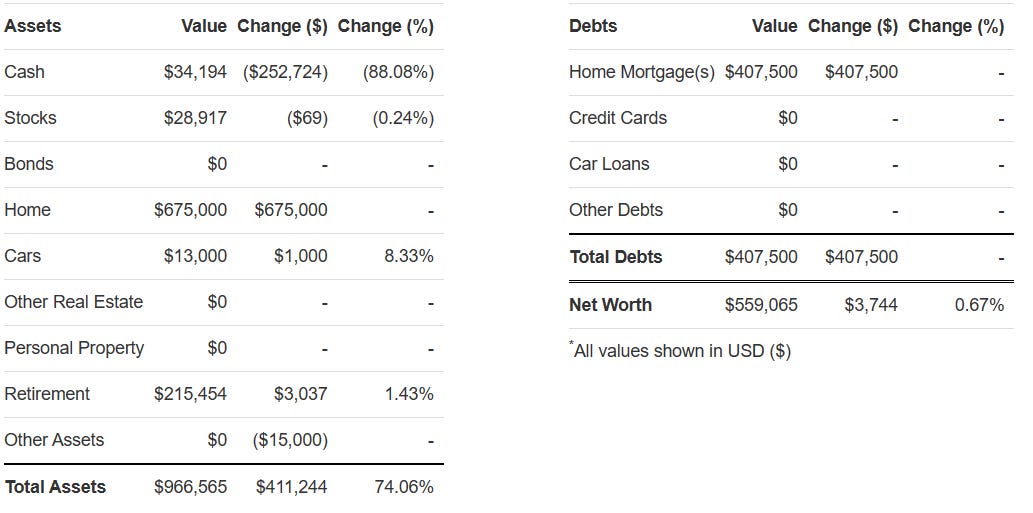

2010 (age 33) - Home purchase in May - Baby born in June

After their new home purchase, you can see cash decreases from the down payment and home equity increases (home minus home mortgage). Retirement savings continue to increase from regular contributions. Below is their May 2009 net worth composition. Net worth crossed $500K and retirement 401(k) continues to increase as % of net worth (from 26% a few years ago to now being 38% of net worth).

2012 (age 35) - Retirement savings and taxable brokerage increase - they begin saving in a 529 plan for kids college - They set some financial goals for 2013

“Looking good at the end of the year. Started accelerating mortgage payoff, adding 1K to payments which will cut to about terms of 15 year. Still not certain this is the best plan of attack, but as long as we are still saving considerably this should be good. Goals in the next year is to get to $200K in the bank, while continuing to payoff mortgage with the extra payment.

2016 (age 40) - First million in net worth achieved!

Below is their net worth as of April 2016. Retirement savings increase to 47% of net worth and are now largest % of net worth. They sets next financial goal to increase taxable brokerage accounts (not just retirement accounts).

“Retirement has increased, and debt (mortgage) has decreased…We should be saving more, but is definitely getting harder with the kids.”

“Goal achieved. Over 1mil net worth before 40. This is great and all, but ~78% of my wealth is in retirement + home equity. I only really have 18% in liquid assets. It's great to have that cushion, but it doesn't feel like it's nearly enough. So good, and not so good. Next goal is to reach liquid assets > debts.”

2018 (age 42) - extra mortgage payments - saving both cash bonus and stock vesting - leased a new car - creating financial metrics and mindset for market dips

“Lately though I have been evaluating things on total debt – liquid assets. This a much better measure, because it takes in to account my current credit card (which we pay every month), and the car lease which right now is about 20k.”

“As the market dips, I’ve been buying stock. Basically whenever we hit recessions I will continue buying. Looking at pullbacks greater than 20% for small buys…. anything greater than 30-35%, buy a ton more. Already started this a bit.”

2020 (age 44) - The COVID Pandemic!

Retirement account peaks at $750,400 in January 2020 and decreases to $611,500 by March 2020. That’s a ~19% ($138,900) decrease in 2 months.

What you don’t want to do is sell at the bottom. As you can see, they stay the course and retirement accounts reach a new all-time high $900,200 by December 2020.

2021 (age 45) - Passing the $2M net worth milestone!

17 years for the first million and 5 years for the second million in net worth. What has changed since reaching $1M net worth back in 2016 (age 40)?

Retirement 401(k): now the largest % of net worth ~$1M - up over $500K since 2016 - 49% of net worth

Taxable Brokerage/Stocks - increase to 26% of net worth with incremental savings and returns outside of 401(k)

Home - no adjustment to home value in 5 years (but value has likely increased) - additional payments on mortgage reduce remaining balance to $249K - Home equity makes up 20% of net worth

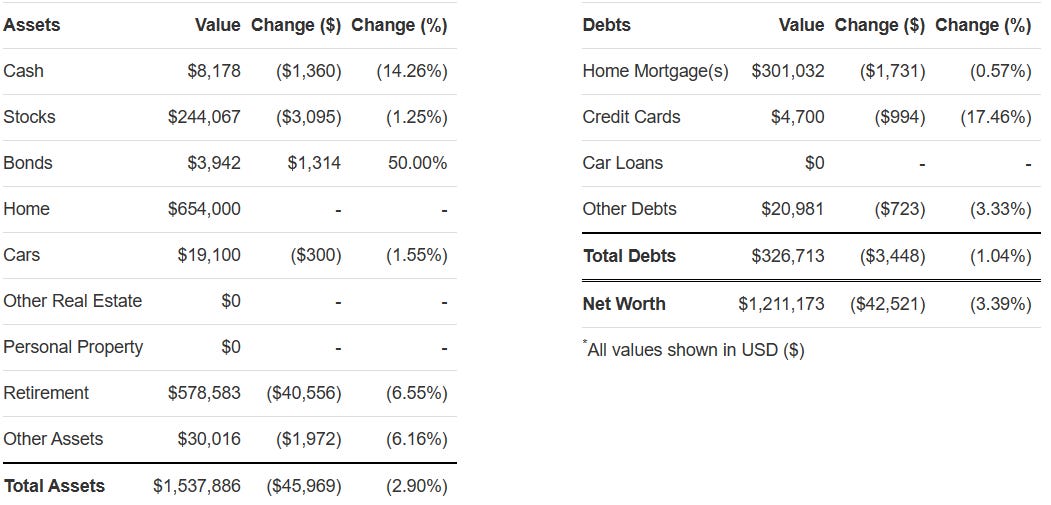

2022 (age 46) - Another down market year!

Retirement account peaks at $1,038,250 in March 2022 and decreases to $869,920 by September 2022. That’s a ~16% ($168,330) decrease in 6 months.

Again - what we see is lots of volatility as the market is adjusting to increasing interest rates and the risk of a recession.

2024 - (age 47) - New financial goals for 2024

Lots of great content on his blog. Here are just a few excerpts on his new financial goals from January 2024. He creates various 5 year projection scenarios with related probabilities (see chart below).

“Retirement to $1.5M is the next step in retirement savings and then $2M. Focus on strategy and sound investing here.

The 5 year goal of a $5M Net Worth. Current is $2.75M, so saving and appreciation of $2.25M over 5 years.”

2024 - (age 47) - current net worth as of February 2024 is $2.95M - getting really close to $3M!

5 take-aways from this net worth story:

EARNINGS - He focused on increasing his skills to increase his earnings

TRACK NET WORTH - He started tracking his net worth in his 20s (don’t just know your income - you also need to understand how much of your income is being saved to create future optionality). Remember, net worth only increases from the income you save and don’t spend.

SAVE AND INVEST - He started saving and investing early. He also increased his savings for both retirement and taxable brokerage as his income increased over time

SET FINANCIAL GOALS - He had financial goals since his 20s. Even in 2024, he still has a 5 year projection on how to get to $5 million net worth

MINIMIZE DEBT - He minimized debt by making extra payments on his mortgage and had very minimal use of consumer debt

If you’re not already, start tracking your net worth!

If you would like to see more financial information on the individual discussed today, you can click here username: jbmil and continue to follow their path to financial independence and maybe even early retirement. You can also join thousands who are tracking their net worth on networthshare.com and be encouraged monthly by a likeminded community. Also, subscribe to this weekly Net Worth Stories newsletter for real life examples (net worth stories like this and other useful tips to create the life you want!)

NetworthShare helps you calculate net worth, and track it online. You can publicize your net worth anonymously (or keep it private), compare it to others & see where you stack up. There are interactive charts that let you slice & dice community data (like those included in this newsletter).

It's also a community of financially like-minded people where you can ask questions, get advice, and share financial stories. You are able to search by your occupation, age range, education level, or salary range and see where you rank!

Looking for more TenWilsons content?

Follow TenWilsons on twitter where you can get daily content and other helpful financial tips.

Feedback or comments?

If you enjoyed this article, please press the like button (at the top or bottom). Also, let’s get the conversation going - what financial goals / milestones do you currently have?