The story of a 29 year old achieving a $300K net worth. 5 year history shows all the financial details.

From median net worth to 90th percentile net worth (compared to similar-aged peers)

Net Worth Stories:

Every Wednesday, we focus on a net worth “story” to help you peek inside someone’s personal finances and get the inside view that nobody usually talks about. This week we have a 29 year old accountant with a masters degree that is now earning between $90-$100K/year.

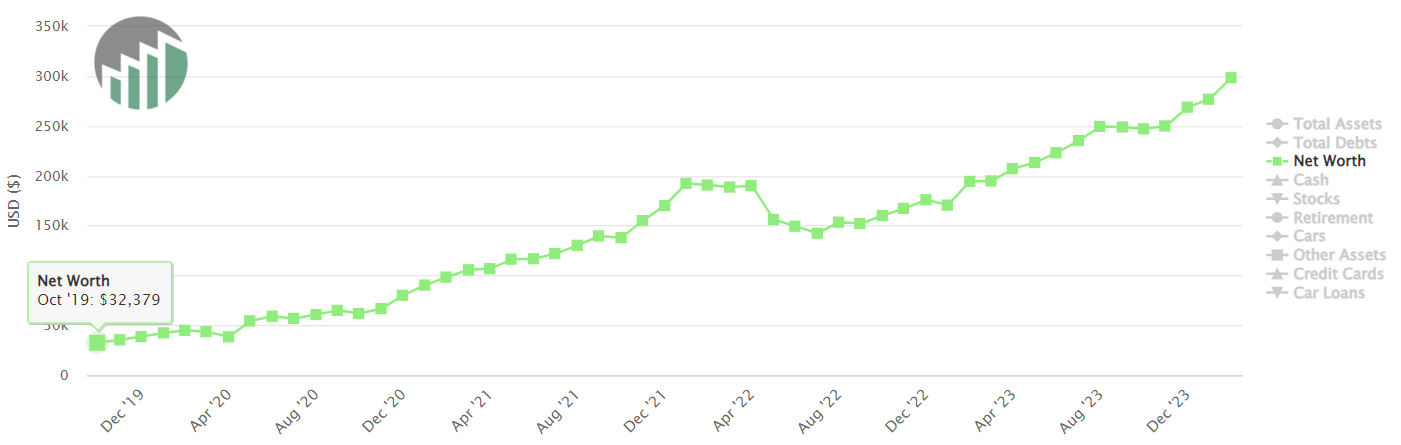

His net worth history starts in October 2019 (age 24) at $32,379. At this point, he is only a year or two out of college and has already been saving and investing in his 401k at work. As we talked about last week, saving your first $100K in net worth is the hardest. Why? You don’t really get any of the benefits of compounding that will come over time. You literally have to start saving and investing a portion of your income (forgoing some consumption). You can see below he achieved his first $100K in net worth at 26 years old.

Crossed $100K net worth - March 2021 - age 26

Crossed $200K net worth - April 2023 - age 28

Crossed $300K net worth - February 2024 - age 29

How did he do this? 5 years of net worth history and details below.

Current Net Worth Composition:

Retirement (401k) (39% of net worth)

Taxable Brokerage/Roth IRA (50% of net worth)

Cash (7% of net worth)

Car (4% of net worth)

Discussion on net worth composition:

His net worth composition is heavily weighted toward investments both in his retirement account (401k) and stocks in brokerage accounts (Roth IRA/Taxable). Retirement accounts represent almost 40% of his net worth and stocks in brokerage accounts represents another 50%. One of his current financial goals is to save for a home down payment (more below). He also has $21,536 in cash which represents ~7% of his net worth and seems sufficient for his current lifestyle. Below includes 5+ years of details in each of these categories to show the steps and actions that together allowed him to reach ~$300,000 net worth in 5-7 years post graduating from college.

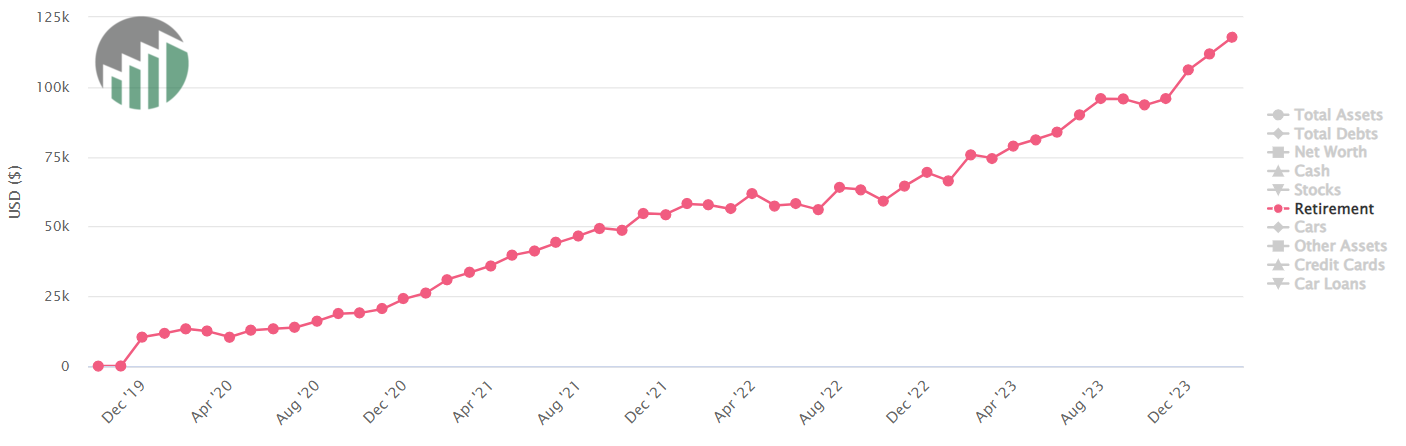

Retirement Savings:

He started saving consistently in his employer 401K with his first job and now his retirement savings make up almost 40% of his net worth. He did experience some market volatility in balances but new contributions and the employer match mostly kept the balances going up during these periods. If you zoom in, you can see a slight decrease in March 2020 at the beginning of the pandemic. In addition, sideways action during the 2022 down market. Despite the volatility, he kept investing with every paycheck and now at the end of 2023 and even into 2024, he is at an all-time high of $117,811 in retirement savings.

Retirement accounts December 2019: $10,359

Retirement accounts December 2020: $24,051

Retirement accounts December 2021: $54,404

Retirement accounts December 2022: $69,296

Retirement accounts December 2023: $106,217

Retirement accounts February 2024: $117,811

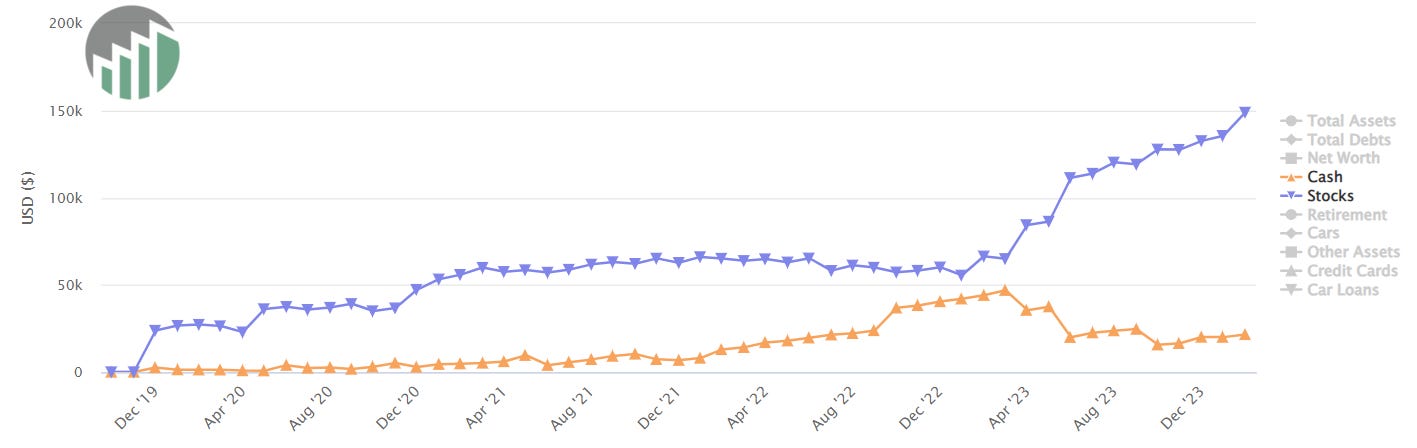

Brokerage account

In addition to investing in his retirement account (401K), he is also saving in a taxable brokerage account and/or a Roth IRA. The first investments were made in late 2019 and 2020. The balance was $50-55K for the next couple years and then it looks like he invested some cash that was being saved back into the market in early 2023. In 2023, the market had solid returns boosting the investment balance to almost $150,000 in early 2024.

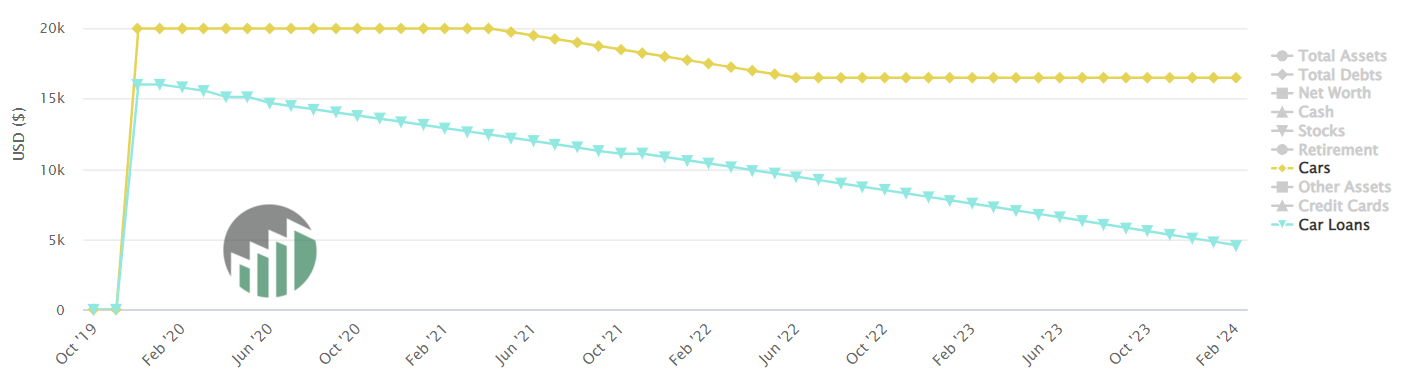

Car

He purchased a car for $20,000 in December 2019 and financed it with a $16,000 car loan. You can then see the value of the car declines to $16,500 by February 2024. After 4+ years of car payments, the remaining balance of the car loan is now $4,580. Therefore, the ‘equity’ in the car is $11,920 ($16,500 value less $4,580 car loan).

The importance of goals and intentional finance decisions

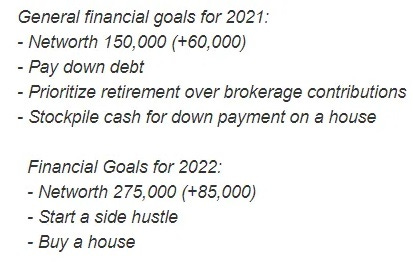

As you can see, this net worth story is a real example of taking intentional actions related to your finances and even setting annual financial goals for yourself. Below are goals that he set at the beginning of 2021 and 2022:

The 2021 goal was achieved as net worth increased to $170,000 by the end of 2021. However, in 2022, net worth ended the year at ~$175,000 as markets were down offsetting even the contributions and matching in the 401k. However, the benefit of continuing to invest in down markets meant that in 2023 when the market rebounded, his net worth increased to ~$270,000 in 2023.

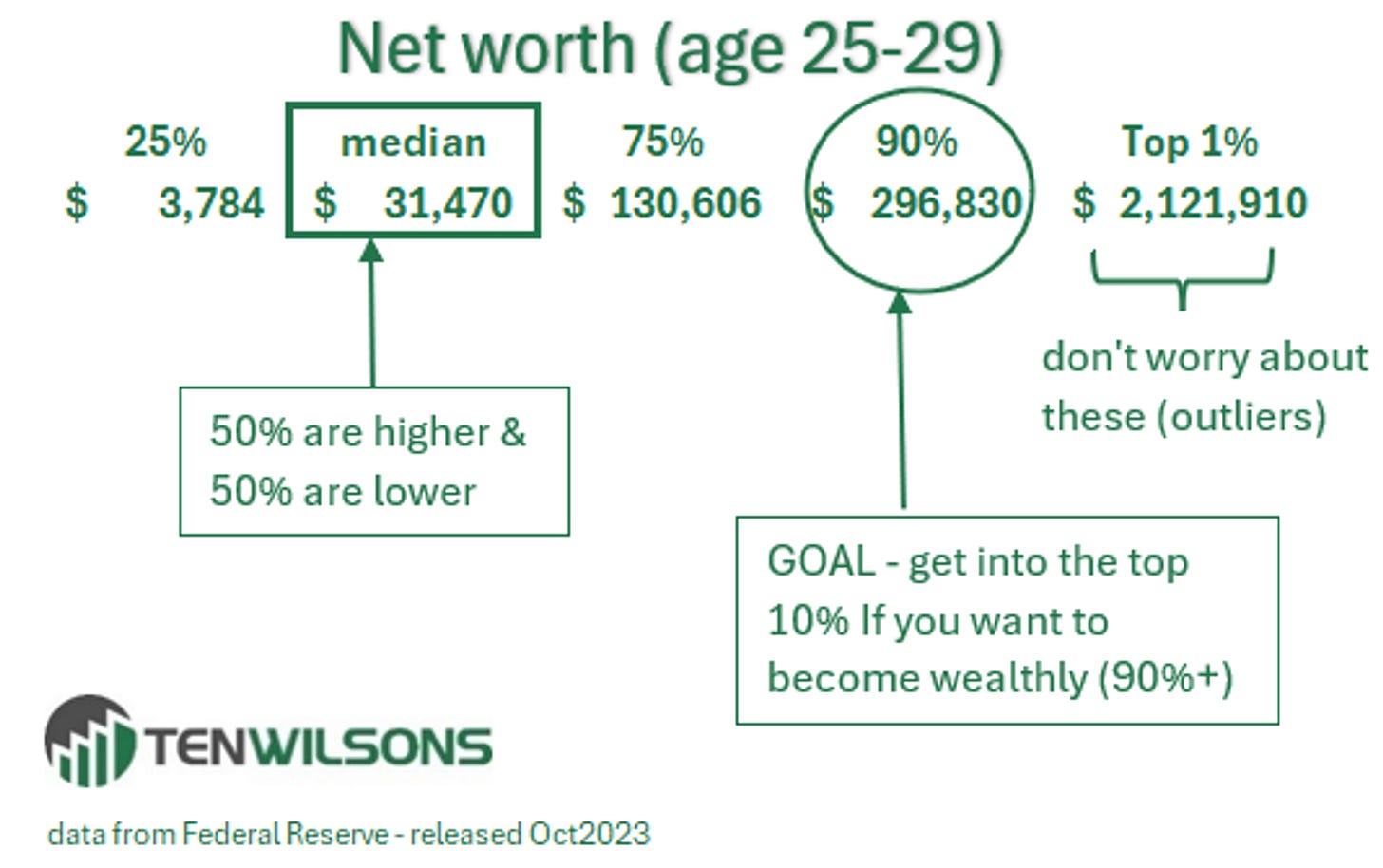

Comparison to net worth averages/median for similar age

Below we show the median and various percentiles of net worth for someone between the ages of 25-29. He has reached the 90% percentile for his age and now has liquid cash/investments for a home down payment. He had planned to buy a home in 2022, but did not likely due to increasing home prices and higher interest rates. In addition, he has over $100,000 in retirement accounts.

This is another great example of following the 5 proven ways to build wealth. 1) focus on gaining skills to increase your earnings 2) start and increase your savings rate as your income increases 3) don’t just save - you need to invest 4) be intentional about spending and 5) minimize debt and lifestyle upgrades.

If you’re not already, start tracking your net worth!

If you would like to see more financial information on the individual discussed today, you can click here username: br and also follow their path to financial independence. You can also join thousands who are tracking their net worth on networthshare.com and be encouraged monthly by a likeminded community. Also, subscribe to this weekly Net Worth Stories newsletter for real life examples (net worth stories like this and other useful tips to create the life you want!)

NetworthShare helps you calculate net worth, and track it online. You can publicize your net worth anonymously, compare it to others & see where you stack up. You don’t provide any specific account or log-in information like some sites. There are interactive charts that let you slice & dice community data (like those included in this article).

It's also a community of financially like-minded people where you can ask questions, get advice, and share financial stories. You are able to search by your occupation, age range, education level, or salary range and see where you rank!

Looking for more?

Follow TenWilsons on X (aka twitter) for daily updates & more wealth building tips