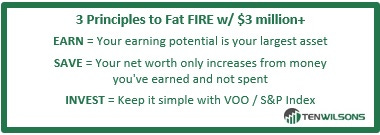

3 proven principles that can allow you to retire early with $3 million+ net worth

EARN - SAVE - INVEST

Would you like to retire early and have $120,000 to $200,000 of annual spending for the rest of your life (Fat FIRE)? The math of early retirement is not hard to understand but it does take intentionality for about 10 years at the start of your career to accomplish. It comes down to 3 principles (EARN - SAVE - INVEST). Those that accomplish Fat FIRE did it by participating in their employer 401k plan and buying their first home!

EARN

Most multi-millionaires started off in careers earning normal salaries $35,000 to $50,000/ year. They worked on increasing their skills, continuously learning new things and being willing to work harder than most. With that comes raises, promotions and larger annual bonuses. Your earning potential is your single largest asset you have so invest in this and maximize its potential. Of our 1,200+ database of multi-millionaires, working for someone else (mid size to large companies) and increasing their earnings is how 80% of them achieved Fat FIRE. It’s not from side hustles, working at a startup that goes public, real estate investing, owning their own business or investing in real estate. Sure these are ways that can work, but statistically it’s not how many achieve it, its over emphasized in social media due to survivor bias (you only hear the success stories).

SAVE

Savings is just as important as what you earn. The single way all multi-millionaires achieved Fat FIRE was by spending less than they earned. Especially in the first 10 years, savings rate is far more important than investment selection or return percentage achieved. You need to get to your first $100,000 of savings.

Everyone says the first million is the hardest. Actually the first $100,000 in net worth is the hardest. Just like a snowball, starting it off is hard but once you get it rolling, the snowball (your net worth) really starts to compound faster than you think it will. We’ll show you many examples of couples achieving FIRE (financial independence - retire early) with $2 million, $3 million or even $5 million earning no more than $100k from their job.

This will require spending less than you earn. If you make $40,000 a year and limit spending to $30,000 a year, you can save $10,000. Even at high income levels, there are far too many households that make $100,000 a year or $150,000 a year and spend 100% of what they bring home or only are saving 5-10% vs saving 20-40% of their income and creating future optionality to retire early.

Your net worth only increases from the money you’ve earned and not spent.

INVEST

Investing is the step that can really help accelerate you net worth and opens the door to compounding. This is where the money you saved (didn’t spend) starts to earn you more money without you having to work (best side hustle ever!). The three factors to focus on here is amount invested, time invested and rate of return.

First is amount invested - the more you save and invest of your earnings, the faster your net worth will increase. Think about trying to save the majority of your annual bonuses and living only on your salary (less 401k savings).

Second is time invested - The longer your money has to work, the more it will grow. This is due to compounding. Time is the best way to maximize your investment growth.

Third is rate of return - the annual rate of return will allow your investments to compound at a faster rate. Earning .5% in a bank savings account is not the same as 8-10% stock market returns over time. Caution - this involves many different risks. Most multi-millionaires did not get wealthy on “picking the right stock”. The media will focus on tesla or apple millionaires but these are exceptions not how most achieve Fat FIRE status. Keep it simple like majority of multi-millionaires and invest in passive S&P index type ETFs (SPY or VOO).

EXAMPLE: