A math teacher in California who earned less than $100K/year has a $1.2 million net worth at age 44 PLUS 14 other net worth updates / stories!

15 net worth updates from ordinary people building wealth.

Weekly Summary - Net Worth Updates:

Each week, TenWilsons will publish two articles. First, on Wednesday, is one long-form detailed ‘net worth’ story. Second, on Saturday, is a weekly summary that is curated from reviewing hundreds of articles, personal finance blogs, and social network updates to find net worth updates posted in the last week.

This week we have 15 new net worth updates / stories. These are net worth updates from ordinary people in various professions and at different stages of building wealth. Most started from $0 net worth or a negative net worth due to student loans.

We have several net worth updates from those in their 20s/30s that are just reaching their first $100K in net worth. In addition, we have a wide variety of net worth updates, many in their 20s with student debt, some feeling behind in their early 30s and moving back home, to a teacher with $1 million+ net worth, a marketing professional, as well as an unhappy dentist and a laid off software engineer. There also are a several examples of those that have intentionally chosen to avoid lifestyle upgrades and now have more flexibility in their later years.

The goal of TenWilsons and NetworthShare collectively is to provide the tools and community to educate and motivate others to make more "informed" or "intentional" financial decisions and minimize the use of consumer debt

Sometimes the best opportunity for individual growth is by finding, watching, and learning from those that are just ahead of you. We hope you use these stories to make more informed financial decisions and create the life you want. Maybe you have been tracking your net worth for years or maybe you just found this site and are calculating your net worth for the first time. Either way, talking about finances with others is not easy, in fact, it is often considered taboo in our society. Therefore, this is a community where anonymously you can share and celebrate your financial milestones! So much of our society is focused on visible wealth (homes, cars, vacations, etc.) but as you will see for those that are trying to build wealth, most of it is not visible (it’s in a 401(k), brokerage, or bank account).

Each of these short net worth updates are teasers of their net worth stories. We try to highlight 1 or 2 takeaways, anecdotes or ideas that will hopefully inspire you (to conquer debt, save for retirement, reduce expenses, etc.). Click on any of the net worth numbers below for a link to the source of the information. See you next week!

20s:

($115,000) - age 25 - married no kids - they are like many that start with a negative net worth (primarily due to student loans $91K) with possibly more student loans to finish a Physician Assistant degree that will then have a $100K starting pay. They a feeling a little discouraged knowing they need to save for a house and kids. Takeaway - they should look to limit any other consumer debt (car loans) until they at least pay off the student loans.

$120,570 - age 26 - married no kids - this couple has several money diaries going back to when they had a negative net worth in 2021. Also in 2021, they purchased a a home in Indiana for $275,000. Today, they have still have $34K in student loan debt but they also have ~$90K in their 401(k)/Roth IRAs, $67K in home equity as well as they started an HSA and have $8K cash. Takeaway - many start off in their 20s with negative net worth (student loans) but that doesn’t have to prevent you from starting to save for retirement and get the benefits of compounding

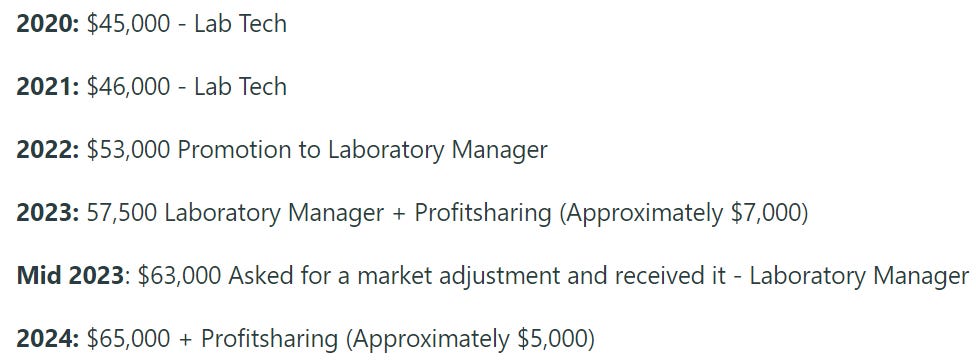

Salary Progression: “I've been working in my field for almost 4 years and my starting salary was $45,000. Until this year, my husband out earned me now we make roughly the same salary.”

$150,000 - age 28 - moved to a higher income fairly quickly - Take-away - despite a higher income they are trying to minimize lifestyle inflation by avoiding debt and driving an old car. “Stable job with a salary of $135,000 annually + a bonus of around $55,000. My credit score is around 750. No student debt or car loans, basically no debt. I have an old car that I bought with cash. I do not own any real estate. No dependents. My monthly saving rate is around 30% of my salary”

$230,000 - age 25 - purchased a home in 2001 (it’s appreciated $60K) - currently earning 73K as a business analyst - Take-away often some luck is involved but typically it’s hard work, sacrifice and delayed gratification that helps one build wealth over time. “I have no debt outside of my mortgage and worked hard in both high school and college to get a lot of scholarships. I’ve been working since I was 16 and became an RA to cover my room and board. In addition, I attended community college for my first two years and only paid $5,000 a year in tuition and lived at home to save money. My last two years I transferred to a public university and paid for my tuition out of pocket with savings, scholarships, and being an RA.”

30s:

$100,000 - age 35 - feeling behind for their age but achieved their first $100K in net worth - “I work in the nonprofit sector - currently earning $82k - and live in a mid to high COL city. I have zero debt and am currently renting. I'm finally in a place where I'm able to save ~35% of my take-home, which feels great.”

$250,000 - age 38 - 7 year history of tracking their net worth - Take-away - it’s usually good to have a goal so you know what you are working toward - “Honestly, my goal is just growth every year. Sometimes I feel like I’m behind for my age, so I just try to focus on getting to a place where I’m comfortable. Honestly, I think 300K has been a mental goal for me for a while. The next one would be 500k. But I know that takes time”

$189,034 - age 31 - lives in Vancouver, Canada. Majority of net worth is in retirement accounts - Income has increased from $11/hour to $85K/ year but cost of living is high. In order to save money and help with family caregiving, they are back living at home - “There are benefits to living at home: I pay little rent, I don't have a car loan, I don't pay for insurance etc. I also don’t have privacy and there's a lot of emotional labour I've had to start doing again. I am back in the thick of some incredibly irritating and enraging family dynamics, so I flip-flop between moving out again and staying here. On one hand, the cost of living, on the other hand… my family.”

$1,100,000 - age 33 - married - dual income no kids - achieved first $1M net worth faster than they thought due to favorable markets - They provide a ton on information on career progression, work/life balance, annual spending/saving, financial goals ($1.9M) and their desire to potentially retire early. Takeaway - they started from a low income family, have been working hard and saving high percentage of since 2012 and achieved $1M net worth in their early 30s which is very hard to do. “I grew up in a low-income household, went to a decent college (huge privilege of great financial aid), and found my way into the workforce in 2012 with a good, but not crazy salary. Paid off the remaining student loans. Got a part-time grad degree paid for by my job. Got married. Bought a home. Got another part-time grad degree paid for by my work. Was steadily promoted and increased my earnings.” “We are definitely saving a lot of money. Probably $120,000/year. And that is crazy–we are saving more than I made up until about 5 years ago.”

$2,000,000 - age 34 - dentist for 8 years - earning $500K as a practice owner but is not enjoying the job - has $875K in retirement/taxable brokerage and is invested in 5 investment properties. Take-away - going after a dream job with a big income does come with certain sacrifices and potentially regrets “I’ve been a dentist for 8 years and really have grown to not enjoy it. I haven’t enjoyed life or traveled as much as I’d like too.”

40s:

$897,000 - age 40 - married - no kids - She is a senior digital director in marketing in Virginia - $140K base, $35.5K bonus and partner earns $67.5K - Take-away despite considerable net worth now, still worries about money after previously having to house hack with roommates to cut spending and payoff credit card debt “I do not worry about money now. I have gone through periods of worrying about money. I racked up five figures of credit card debt as a young adult and had to change my lifestyle to pay it off. At that time, I found a bedroom to rent with roommates on Craigslist to cut my monthly housing expenses in half. The second period was at the start of the pandemic, when my spouse was laid off and collecting unemployment. At that time, our expenses were…too high to live on only my income. I lost a lot of sleep at night for several months until he was able to start working again.”

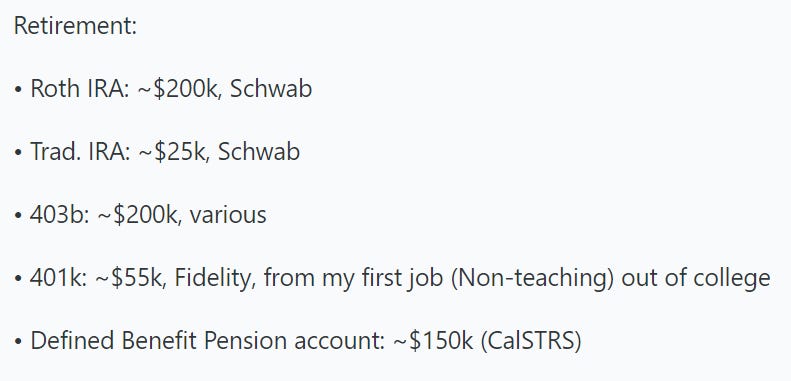

$1,200,000 - age 44 - math teacher in California achieves $1 million+ net worth and has never earned more than $100K/year - has been maxing out Roth IRA contributions and contributing 6% (with full match) to a 403(b) retirement plan which is similar to a 401(k) for government employees. They are also eligible for pension payments starting at age 55. Takeaway - even on a modest salary, if you start saving early, avoid lifestyle upgrades and just let compounding help over 10-20 years it’s possible to accumulate real wealth even as a teacher “Starting as early as 55 (lowest retirement age). I ran the calculations and found that if I do retire at 55, I will get roughly $2k/mo, and it goes up to roughly $3.5k/mo if I wait until 63 to take payments.

$3,968,000 - age 49 - married with 16 year old twins - lives in the northeast part of the country - they completed 3 long form financial interviews (2018, 2020, March 2024) that provide lots of financial details and decisions over the years. Income really accelerated into these peak earning years starting 5 years ago. Take-away - It hasn’t been a straight line up - they have experienced pay cut (avoiding layoff) as well as big bonus years being in sales “I managed to navigate through challenging conditions at two previous companies which led to temporary income reductions within the past decade. We felt the impact of those income reductions when they occurred, and they prevented me from investing as much as I would have liked during those times….The biggest thing we’ve done has been to focus on earning more income through my sales career while not increasing our spending dramatically and investing the difference (Earn, Save, and Invest)”

$4,350,000 - age 45 - married with 4 kids - Bay area - IT director level - high income - sole income for family and recently laid off - Takeaway - despite a high income, they managed to avoid a lot of lifestyle inflation and also have stayed in same house with a 2.5% mortgage ($1,550/monthly payment) “Expenses - about 110k/year at current rate (HCOL area). Our lifestyle is rather minimalist, the only thing we splurge is vacations (2-3 times year, accounted for in 110k annual expenses)”

50s:

$5,900,000 - age 54 - single with 3 kids (in college and young adults) - lawyer/mediator living in Atlanta area - expenses not including income taxes $90-105K - Takeaway - she has managed to avoid increasing lifestyle expenses but now feels urgency to manage health as due to emotional strain and stress of work “Annual expenses not including income tax is 90-105k, with the high end including some costs I could cut in down market such as travel. I also have well managed heart failure that doesn’t affect me day to day but is in the back of my mind regarding future medical costs/ability to work.”

60s:

$2,400,000 - age 65 - married for 46 years - 2 adult daughters - another long-form financial interview - they are retired now - when they left work she was earning $80-120K/ year and he was earning $75K/ year - Annual spending is now ~$75K/year and is less than their pensions + social security. Take-away - it’s not always about earning more but spending only on things that you want (not trying to impress others).

What’s your best tip for spending less money? “Stay away from commercialism!!! It is not easy in our capitalist society with our hefty communication infrastructure. Turn it upside down and you will be “Under the Radar”. In other words, avoid TV, mute commercials, use DuckDuckGo, use your animosity (stealth wealth) to your advantage, choose your own direction and live…it puts you in the driver’s seat.”

What is the meaning behind Ten Wilsons?

The $100,000 bill is the highest denomination ever issued by the U.S. Federal Government. Woodrow Wilson is the president on the $100,000 bill.

In theory, if you had 1 of these $100,000 ‘Wilson’ bills you would have $100,000 net worth. If you had 2 Wilsons you would have a $200,000 net worth. Therefore, if you had 10 Wilsons you would have a $1 million net worth. Therefore TenWilsons = Millionaire

Looking for more TenWilsons content?

Follow TenWilsons on twitter where you can get daily content and other helpful financial tips.

Please like and share with others!

If you enjoyed this article, please press the like button (at the top or bottom) and consider sharing it with others!