Financial journey from a negative net worth at age 24 to multi-millionaire before age 40.

14 years of net worth history and detailed financial decisions

Net Worth Stories:

Every Wednesday, we focus on a net worth “story” to help you peek inside someone’s personal finances and get the inside view that nobody usually talks about. This week we have double income couple with kids (both 38 years old).

There are over 120+ monthly net worth entries on networthshare.com! This provides incredible insight into life events and financial decisions as they happened. The journey starts in 2010, 2 years after graduating from college with a negative net worth. We’ll highlight some of their financial decisions: paying down student loans, saving for home down payment, contributions to retirement savings, buying used cars (instead of new) on their financial journal to multi-millionaire status before turning 40 years old. We hope you can relate to something about his financial journey and we hope you are inspired to set your own financial goals. Enjoy!

January 2010 - Age 24 - graduated in 2008 - purchased condo - negative net worth of ($18,265) in January 2010 due to student loans of $45,116.

March 2011 - Age 25 - focused on paying down debt and making 401(k) contributions - $9K total debt decrease - gets to $0 net worth!

April 2014 - Age 28 - gets married - pays off student loans and combining finances adds $100K+ to net worth

“Got married and combined balance sheets with the wife”

April 2015 - age 29 - DINKs (double income no kids) - changing jobs to increase earning potential - financial goals are focusing on paying down debt, maximizing 401(k) contributions, saving for home down payment ($100K) and building emergency savings ($20K)

Last week at current job before moving over to sales. Because I won't be able to contribute to 401k until I've been at the next place for a year I've put 100% of my final two paychecks into my current 401k. Still trying to build up our pile of cash for a 20% down payment on a house. That's on top of our emergency fund, so it could be a while.

December 2016 - age 31 - net worth $492K - maxing 401(k) contributions, increased goal of saving $120K to $140K for home down payment. Most importantly, minimizing lifestyle upgrades (cars/home) as they focus on saving for a home/retirement

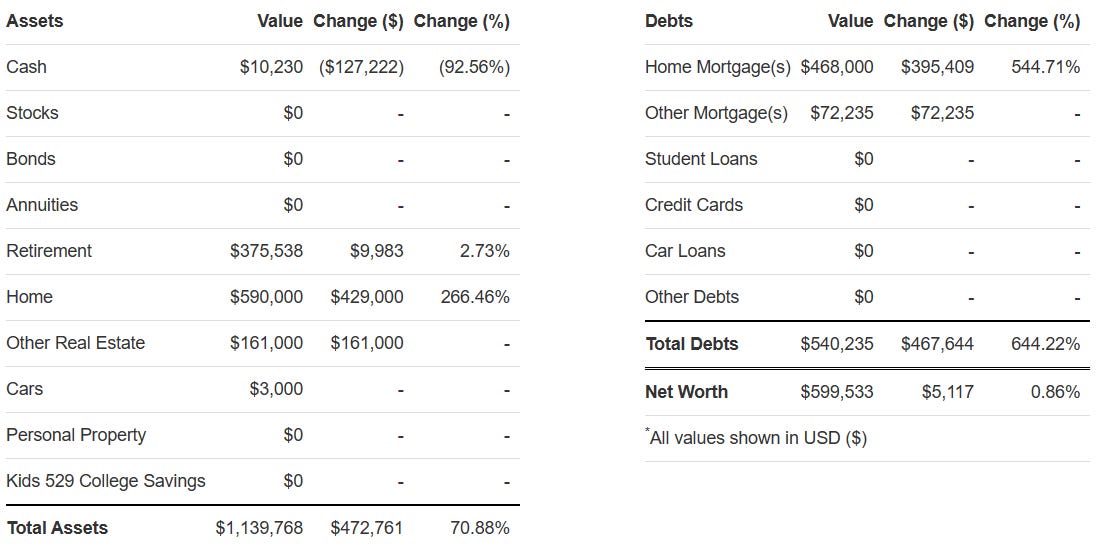

June 2017 - age 31 - purchase $590K home with $468K mortgage - condo moves to other real estate (rental) - cash decreases to $10K

“We put in an offer for a house in early May (closed June) and it was accepted! And we are going to have just enough to put 20% down thus avoiding the PMI. New goal is to replenish our emergency fund as we purchase new home goods”

Visible wealth comment: Everyone sees them buy a new home for almost $600K (but majority of that is with a mortgage). Their real wealth is invested in their 401(k) - over 3X their home equity! This seeding of their retirement will propel their net worth upward in the coming years.

Home equity 20% of net worth - Retirement Accounts 63% of net worth

December 2018 - age 33 - avoid consumer debt - save cash to purchase 2nd car and do some home improvements - still maxing retirement savings - start building taxable brokerage savings

“Trip to Maui Booked. Plan for April is to pay income tax bill and build pergola in back yard. Then May thru July to save up to pay cash for 2nd car, Nissan Leaf”

December 2019 - age 34 - reach first million in net worth - purchase 2017 used car (replacing 18 year old car) - saving for kids college in 529 plan - investing on work ESOP (employee stock purchase plan)

“Sold 2001 SUV and purchased 2017 SUV. Continuing to put $1,000/month into our daughter's 529 college fund. Next goal is some work on the kitchen then plan to purchase more stock in my ESOP. Stock market at record highs. Tenants moved out of rental at end of October. Working on make ready repairs with mgmt company now to get a new tenant asap.”

March 2020 - COVID pandemic hits - $165K loss on investments - not worried as they have 2 incomes and previously focused on building emergency savings and avoiding debt

“Big down swing due to COVID-19. My 401k is funded for the year. Still working on funding the wife's. Since I'm 100% commission and expect my income to drop significantly in the coming months we'll be hoarding cash for the foreseeable future. Thankfully my wife has a steady income in through this crisis.”

December 2021 - age 36 - income didn’t drop as much as expected - market rallied back in 2020 and 2021 - hit $2 million in net worth - able to refinance both homes at lower rates - saving cash to purchase new house

“My commission income has not yet dropped as much as I expected it to thankfully. One good note that came out of this, we're in the process of refinancing our home to a lower interest rate. Refinanced our primary residence with a 30 year fixed rate 3.125% mortgage. Did a cash out refinance of our rental property. Went from 4.5% to 3.5% on a 30 year fixed with $60k back to us. Building up cash to purchase another house. Aiming to have roughly $150k - $200k to put down on our next house in mid 2022. Planning to keep our current house as a rental. 1st million took over ten years. The second million took 2 years and 5 months.

Visible wealth comment: They have continued to live in the same house (and purchased used cars) as their net worth passes $1 million and $2 million. Home has appreciated from $590K to $695K. However, their real wealth is invested in stocks/investments and cash - now over 7X their home equity!

Retirement Accounts 53% of net worth - taxable brokerage 13% - cash 12% - Home equity 11% of net worth

December 2022 - age 37 - market drops again in 2022 but home prices increase - they don’t panic and increase investments in the market but don’t purchase a new home yet - net worth approaching $2.5 million.

Retirement accounts bottom at $966K in October 2022 after hitting $1.2M in January 2022 (that a decrease of $227K net of new contributions) and end the year at $1.065M.

December 2023 - age 38 - market rallies back +20% - net worth increases to $3 million with retirement accounts ($1.3M) still being highest % of net worth (44%)

“Wife was laid off but received 4 month severance. We've also been moving our cash from a high interest savings, Ally @ 3.75%, account to a Vanguard money market fund, VUSXX @ 4.63%.”

5 take-aways from this net worth story:

EARNINGS - changing jobs to increase earnings potential

PAYING DOWN DEBT - focused on paying down student loans and getting to positive net worth

SAVE AND INVEST - He started saving for retirement right away and increased contributions after paying off student loans. Next was saving for cars, home down payment and emergencies.

SET FINANCIAL GOALS - He had financial goals since his 20s. Starting with paying off student loans quickly and then saving for a home down payment and retirement.

LIMITING LIFESTYLE UPGRADES - They purchased used cars and have limited visible wealth (majority of their net worth is in invisible financial assets).

If you’re not already, start tracking your net worth!

If you would like to see more financial information on the individual discussed today, you can click here username: UTex08 and continue to follow their career path and savings trajectory. You can also join thousands who are tracking their net worth on networthshare.com and be encouraged monthly by a likeminded community. Also, subscribe to this weekly Net Worth Stories newsletter for real life examples (net worth stories like this and other useful tips to create the life you want!)

NetworthShare helps you calculate net worth, and track it online. You can publicize your net worth anonymously (or keep it private), compare it to others & see where you stack up. There are interactive charts that let you slice & dice community data (like those included in this newsletter).

It's also a community of financially like-minded people where you can ask questions, get advice, and share financial stories. You are able to search by your occupation, age range, education level, or salary range and see where you rank!

Looking for more TenWilsons content?

Follow TenWilsons on twitter where you can get daily content and other helpful financial tips.

Feedback or comments?

If you enjoyed this article, please press the like button (at the top or bottom). Also, let’s get the conversation going - what financial goals / milestones do you currently have?