A Fat FIRE lifestyle is FIRE (Financial Independence, Retire Early) but where you don’t have to be frugal in your spending. It means you no longer have to work, but plan on spending more than $100,000/year in annual living expenses. If you want to pursue early retirement, but don’t want to live frugally, then a Fat FIRE lifestyle may interest you. With enough time and the right planning, you can get there by the EARN - SAVE - INVEST strategy. Focus on increasing your earnings through education an skill development, saving a portion of your earnings (living on less than you earn), and then investing that excess earnings in low cost index funds (i.e. bogleheads).

Here’s what you need to know about how to achieve Fat FIRE and overall financial independence.

What Is Fat FIRE?

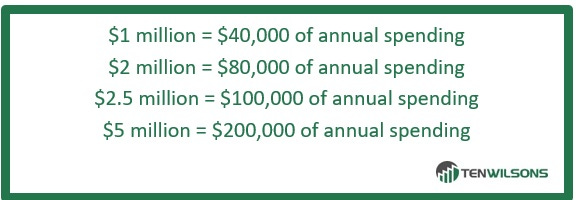

The FIRE movement is about calculating your FIRE number – the amount of invested assets you need to live off of investment income and retire early – and then increasing your income and maintaining your expenses (avoiding lifestyle inflation) to reach your net worth goals faster. You can calculate this as: annual spending x 25 = FIRE number OR or as your FIRE number x 4% (safe withdraw rate) = Annual spending

By avoiding lifestyle inflation many reach this in their 30s and 40s, an approach known as traditional FIRE. But some people don’t want to keep their expenses low, or they can’t because of certain family circumstances. Then comes Fat FIRE.

Lifestyles of Fat FIRE

Fat FIRE is typically classified as pursuing a FIRE number of $2.5 million or more which, with a 4% withdrawal rate, would yield income of $100,000 a year. The motivations of Fat FIRE enthusiasts may include:

No need for either partner or spouse to work every again

Live in a comfortable house with multiple bedrooms and bathrooms if you have kids or luxury condo if you are a childless couple or individual

Budgeting for vacations or lots of travel

Having the freedom to spend on luxury goods

Wanting to retire in a city or location that has a higher cost of living

Save or have enough to pay for all your children’s college education

Drive a safe and reliable car that’s not older than five years

Afford excellent healthcare (gold plan or higher without needing subsidies)

Fat FIRE vs. FIRE

Fat FIRE is the same as regular FIRE, but the numbers are bigger across the board. You want a lifestyle that will require higher monthly expenses, which means your FIRE number will need to be higher and may take longer to achieve.

The $2.5 million net work benchmark can feel significant; know that some people achieve FIRE and retire early with $1 million or less in their retirement savings. Here are some other versions of the FIRE movement.

FatFIRE vs. Coast FIRE

Coast FIRE is a retirement planning strategy that cuts the “retire early” part out altogether. It’s more about peace of mind.

In Coast FIRE, you aspire to reach a certain threshold at which your accounts have enough money invested to let compounding get you the rest of the way to your FIRE number. When you hit your Coast FIRE number, you can stop contributing to your retirement accounts, freeing up monthly income. You don’t have to stop contributing to your accounts when you hit Coast FIRE (also known as Coast FI), but it’s an option.

FatFIRE vs. Barista FIRE

In Barista FIRE, you keep a part-time or low-stress job in retirement for residual income and health insurance to help offset annual spending costs. Many Americans aspire to Barista FIRE without even realizing it; they want to accumulate enough wealth to change or downshift their career.

The name “Barista FIRE” is a nod to Starbucks, which made waves when it began offering health insurance to employees who average 20 hours of work a week. You’re not fully retired, but you’ve downshifted out of an intense career in order to enjoy life more now.

Fat FIRE vs. Lean FIRE

Lean FIRE is complete opposite of Fat FIRE. Lean FIRE is a net worth benchmark that assumes you’ll only have minimum expenses for food, housing, and transportation in retirement. Lean FIRE is sometimes defined as a lifestyle in which your current annual spending will remain under $40,000/year in retirement.

Determining your FIRE number

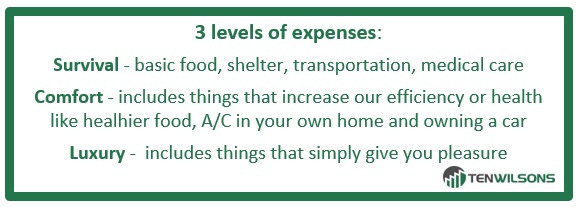

You need to evaluate your desired level of annual spending. To help with this you can consider dividing your expenses into 3 categories. Survival, Comfort and Luxury. This gets you from Lean FIRE to Fat FIRE. Survival expenses are basic food, shelter, transportation and basic medical care. Comfort expenses include things that increase your efficiency or health like being able to eat healthier food, owning your own home and car, etc. Luxury expenses include things that simply give you pleasure like vacations, larger homes, fancier cars and excellent healthcare.