Debt-Free Journey: How a 33-Year-Old Government Employee Conquered $70K in Student Loans and $50K in Other Debt

Net Worth: Negative at 36, $100K by 40 and $1M by 46!

Net Worth Stories:

Every Wednesday, we focus on a net worth “story” to help you peek inside someone’s personal finances and get the inside view that nobody usually talks about. This week we have a 49 year old government employee living in Washington, DC. When the story starts in 2007, she is 33 years old and had just purchased a townhouse right before the financial crisis/housing bubble. At that time, she has a negative net worth with over $67K in student loans as well as other debt.

This is an incredibly inspirational story of determination. The story includes debt (lots of debt), an underwater property and being unable to refinance, taking on a second job, taking on roommates to help pay the mortgage, and driving a 17 year old car. We detail year-by year as she works to pay off $70K in student loans and $50K in other debt primarily using Dave Ramey's snowball/baby step system. Then she begins to max out retirement accounts and start a Roth IRA. She reaches her first $100K of net worth at age 39 and then hits her first $1 million of net worth by 46!

She has over 200 monthly net worth entries on networthshare.com! This provides incredible insight into life events and financial decisions as they happened. We’ll highlight some of the detailed financial decisions, setbacks, and milestones into her financial journal from a negative net worth at age 33 to millionaire by age 46. We hope you can relate to something about her financial journey and we hope you are inspired to set your own financial goals. Enjoy!

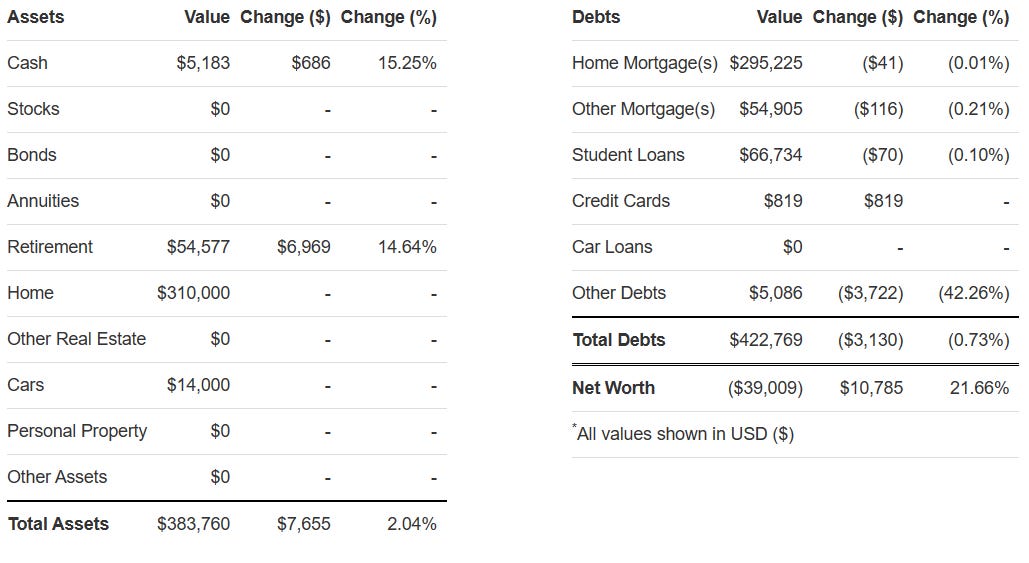

As of December 2007 - age 33 - negative net worth - still have $67,000 in student loans - creates financial goals to start paying down debt in 2008

“I certainly feel that getting out of debt and starting to build wealth is that long, hard journey, but I am excited about where it will lead me! In 2008 I plan to focus on paying off installment debts that will be gone forever once paid in full (i.e., the dreaded student loans!). I am very determined and focused, and finally ready to do the hard work - mainly getting a second job and getting roommates (I have a 3br townhouse near a major university, so getting some grad students shouldn't be a problem I hope). I plan to use all of that money to pay off debt and get out of the hole financially, then focus aggressively on acquiring income-producing assets.”

“My goals for 2008 - 1.) Pay off 2004 Honda Accord - almost there! 2.) Pay off $18.7K loan taken out against my 401(k) for house purchase. 3.) Pay off last of credit card debt. 4.) Gain steady second income in the form of a part time job (applying to various ones). 5.) Rent out rooms for extra income. 6.) Open a brokerage account with Vanguard or Fidelity and start investing in equities!”

December 2008 - age 34 - paid off $24K of debt - second job - 2 roommates @ $600 each - net worth goes more negative due to home price declines

“….paid off car loan, paid down 401(k) loan, paid off credit card debt, obtained second income from a part-time job, renting out rooms for extra income (2 roomies at $600 each) - ALL IN ALL, I AM HAPPY WITH MY PROGRESS”

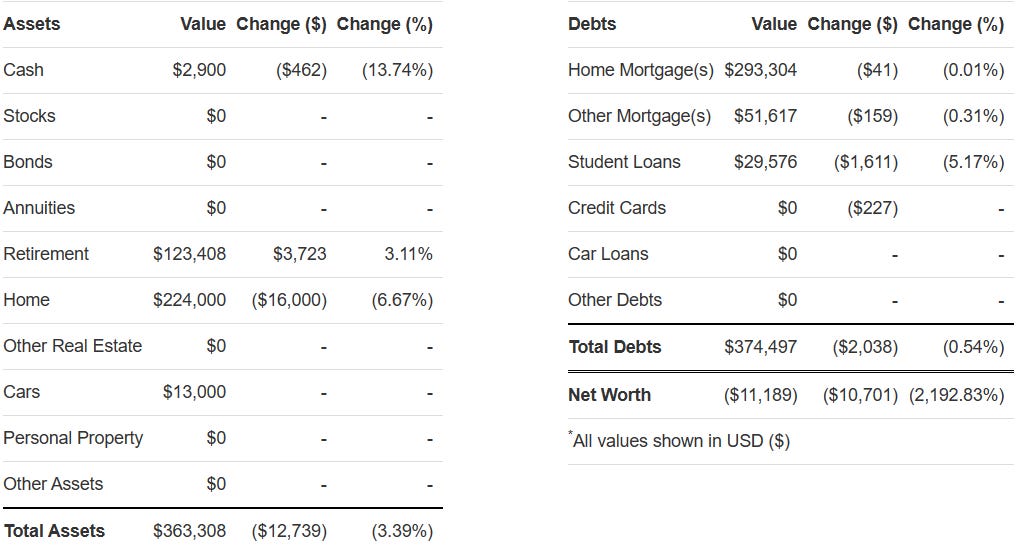

December 2010 - age 36 - 3 years since the start - paid down student loans another $37K over the last 2 years - now underwater on home (mortgage loan > current home value) - financial goals created for 2011

Home purchased for $370,000 in August 2006 - now valued at $224,000

“A new year!! I joined this site 3 years ago in a state of abject despair over the condition of my finances and the amount of debt I had hanging over my head, robbing me of all sense of freedom. I am proud that I have diligently updated this information every month since then and have for the most part stayed on the path of determined debt payoff. I am really happy that my student loans are down to $29,500!!! That is amazing to me!!! I know I can knock them off once and for all in the next 12 months, and though that will take sacrifice, focus and hard work, once that albatross is off my neck, I am going to be one happy camper! This is not to say the RE situation is not horrible; the house is now well over $100K underwater, and the ability to refinance to lower rates is about nil, even though I have near perfect credit. The RE market in this area continues its downward plunge and it seems more folks are foreclosing and short selling, hence the monthly decline in the stated value of the home. The goals for 2011: 1.) Continue my snowball to pay off the Student Loans by year end. 2.) Modest rental increase for roommate whose been at the same rent for 3 years. 3.) Back to 10% gross into my 401 (k). 4.) Add to monthly income through sibling contributions to assist with room and board for parents staying in the house, 5.) Find additional income streams.”

December 2011 - age 37 - continuing to pay down debt - positive net worth achieved!

“Happy New Year to everyone! I managed to get through the holiday travel and gift giving season with no credit card debt thanks to a timely performance bonus and also managed to put $2K to kick off my long term (6-months of expenses) emergency fund. Into the New Year, I'm reading more finance blogs and listening to audio books to really turn my attention to building wealth, increasing income and investing. I have been in rabid debt-payoff mode for many years, and now it's a whole new ball game. I'm going to need to shift into a different gear to really add to my income and reduce my current expenses. Everything is being looked at and re-evaluated; the house, the cable, the phone plan, EVERYTHING! Paying too much for all of those things really adds up and in the long run can have a seriously detrimental effect on ones dreams of financial independence.”

June 2013 - age 39 - achieves first $100K in net worth - home price bottomed in December 2012 at $178,862 (purchased for $360K) and starts increasing in 2013 - still contributing 5% to retirement plan

December 2014 - age 40 - home price increasing - 401(k) increasing - continuing to paydown debt - building an emergency cash fund - net worth $299K

“JANUARY 10, 2015. New amounts to targeted savings accounts - New Car Fund, E-Fund and Escrow account - have been automated on a bi-weekly basis to coincide with payroll. Set it and forget it. Home repairs will remain a primary focus with the intention of off-setting the cost of this major expense through outright rental or taking in roommates. My extra payments on the first and second mortgages have been decelerated as the whole focus is on home improvements and getting the E-Fund to 6 months' worth of expenses, as well as opening up and funding the taxable investment accounts. While I love to see the debt load go down quickly, I need to think long term and focus on asset acquisition and increasing my income/cash flow so as to be able to allow renters to pay down this debt instead of me. I'm currently painting and making other minor repairs, and should be able to advertise for at least 1 roommate in the next month. Currently my only investments are in the form of the company 401(k) and my Vanugard Roth IRA. That need to change. I have reverted my 401(k) contribution from the maximum allowable (tax deferred), to 6% of my gross with 5% match. This too is for the purposes of focusing on getting the E-Fund to 6 months' worth and fixing the home to be rented out. I figure 11% of my gross is good enough for now, and once the former goals are met, I will go back to maxing out the contribution.”

2015 - age 41 - max out 401(k) contribution and Roth IRA contributions - started a car savings fund - opened taxable brokerage accounts - net worth $374K

“Contributing to New Car Fund at $250 every 2 weeks. Honda will be 12 y.o. this year, still runs just fine though. I finally (!!!) opened two-taxable brokerage accounts this. I'm maxing out my ROTH and 401(k) to maximum allowable contributions for 2015, so this is now the only way to go as far as investing more. I'm splitting my discretionary income (savings/debt snowball) between bigger payments on the HELOC and taxable accounts.”

2016 - age 42 - made extra principal payments on mortgage - refinanced from 6.25% to 2.8% (15 year) - net worth - net worth $459K

2017 - age 43 - paid off HELOC - net worth crossed $600K

2018 - age 44 - still contributing to new car fund - extra mortgage principal payments - retirement accounts being fully funded + $500/month into taxable brokerage (stocks) - net worth $636K

“Working overtime (when granted) and putting that and other discretionary income into savings for home renovations and replacing the 15 year old Honda Accord that still drives like a dream and thanks to telework and the wonderful DC-area Metro system, has less than 120K miles on it. Crazy, I know. Hard to get rid of a car that's never spent a day in the shop and has less than 120K miles on it, especially after making the rookie error of buying it new off the lot in 2003. Anyway, I have been dreaming of a new car a lot lately, and trying to stay out of dealerships for fear of making an impulse buy. Haven't had a car note in a decade and I shudder at the thought of carrying that kind of debt again. Hence, saving and we'll see how much I can keep going with the trusty Honda while my "New Car Fund" grows...”

”I'm currently throwing a few extra hundred at the mortgage and still fully funding all the retirement accounts plus another $500/month into a total stock market index fund. Looking to cut a few more expenses and hoping to get to living off of one post-tax/post-retirement contribution bi-weekly paycheck.

2019 - age 45 - furloughed - thankful for emergency savings - rehired - home renovations - $850K net worth

First entry of 2019 “Well thank goodness I focused on debt payoff and saving up for home renovations last year! Thank goodness I couldn't find a good contractor to complete said home remodeling, and thank goodness I didn't give in to the urge to upgrade my trusty 2003 never-spent-a-day-in-the-shop Honda Accord!! As a Furloughed Fed I am now about to miss my second paycheck this Friday, and I am just super grateful that Dave Ramsey, Suzy Orman and the shutdown of 2013 taught me the importance of a several months' savings fund and to abhor debt like the plague. Also glad to have caught onto and followed many of the tenets of the much reviled FI/RE (Financial Independence/Early Retirement) community. Thanks to the many wonderful bloggers out there, sharing about the way in which a high savings rate can be the path to economic freedom, I have focused more on that and getting out of the rat race than keeping up with the Joneses.”

Last entry of 2019 “Hit my goal of $850K NW by year’s end, so I’m happy about that! Here’s to a healthy, happy and prosperous new decade!!

March 2020 - age 46 - pandemic hits - retirement investment portfolio goes down $182K (25%) - she does not sell and keeps investing

October 2020 - age 46 - market rallies back later in 2020 - first $1M in net worth! - retirement accounts 77% of net worth - positive home equity of $100K+

2021 - age 47 - finally replaces the Honda purchased new 17 years ago - home value finally reaches price paid in 2006 - now at 50% savings rate - net worth $1.4 million

“…it’s time to replace the trusty Honda after 17 good years, so hopefully I can maintain my fiscal discipline this weekend when I’m out shopping for a replacement. Lots of nice options out there! I’ll probably get a certified pre-owned, something a couple of years old to avoid that instant new car depreciation. Wish me luck!”

”Home Value Updates Based on REDFIN Estimate. In line with current neighborhood comps. Funny enough, for the FIRST TIME, this is now commensurate with what I paid for it 15 years ago ($370K). That was a heck of a bubble.”

”Upped the amount going to mortgage principal by $250 plus now have a full bi-weekly paycheck going into VTSAX (index fund). So I guess I hit a major goal of living off of less than 50% of my net (after taxes & retirement contribution) income.” Hopefully I can keep it up for a while and stay on track to quit the rat race sooner rather than later.

Now let’s zoom out and look at the net worth progress (by category) over the last 17 years (2007 to 2024)…

Total Debt (2007-2024) - down $252K over 17 years

Home - purchased home for $360K in 2006 - value drops from 2007-2013 - underwater and unable to refinance for 7 years - home value finally gets back to original purchase price in 2021 (15 years later)

Retirement - contributes 5% (enough to get employer match), starts Roth IRA contributions, increases % contribution after debt is paid off - experiences significant volatility during 2020 (Pandemic) and 2022 (market declines)

2020 - market decline of $182,461 (25%) from January 2020 to March 2020

2022 - market decline of $238,930 (22%) from November 2021 to October 2022

Student Loans - started at $70K+, $67K in 2007, and paid off in 2011

Car - Keeps Honda (purchased new in 2003) for over 17 years - creates car savings fund to purchase next used Toyota (no car loan)

Taxable Brokerage and Emergency Savings - after student loan and other debt is paid off - additional emergency savings in cash and Taxable brokerage accounts opened

Net worth - starts off negative in 2007 and goes more negative in 2009/2010 - takes until age 40 to get to first $100K but then compounding and savings increase to get to $1 million net worth by age 46 - setbacks in 2020 and 2022 market declines - and now at all-time high in March 2024 - $1.7 million net worth at age 49

4 take-aways from this net worth story:

SETTING FINANCIAL GOALS - It all starts in 2007 when she set the financial goal of wanting to put herself in a better financial position and start to pay off all her debt at age 33. She creates 5 financial goals to start in 2008.

EARNINGS - She focused on increasing her skills to increase her earnings over time

TRACKING NET WORTH - She started tracking her net worth at age 33 (don’t just know your income - you also need to understand how much of your income is being used to paydown debt or being saved/invested). Remember, net worth only increases from the income you save and don’t spend.

SAVE AND INVEST - She was always contributing to retirement plans (and getting the match). She increased her savings for both retirement and taxable brokerage as his income increased over time after paying off debt.

If you’re not already, start tracking your net worth!

If you would like to see more financial information on the individual discussed today, you can click here username: overcomer and continue to follow their path to being debt free and someday achieving financial independence. You can also join thousands who are tracking their net worth on networthshare.com and be encouraged monthly by a likeminded community. Also, subscribe to this weekly Net Worth Stories newsletter for real life examples (net worth stories like this and other useful tips to create the life you want!)

NetworthShare helps you calculate net worth, and track it online. You can publicize your net worth anonymously (or keep it private), compare it to others & see where you stack up. There are interactive charts that let you slice & dice community data (like those included in this newsletter).

It's also a community of financially like-minded people where you can ask questions, get advice, and share financial stories. You are able to search by your occupation, age range, education level, or salary range and see where you rank!

Looking for more TenWilsons content?

Follow TenWilsons on twitter where you can get daily content and other helpful financial tips.

Feedback or comments?

If you enjoyed this article, please press the like button (at the top or bottom). Also, let’s get the conversation going - did you overcome student debt? What financial goals / milestones do you currently have?